Equinox Partners, L.P. - Q1 2010 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Equinox Partners appreciated 6.7% in the quarter ended March 31, 2010. As of May 31, 2010, our fund was up 9.4% for the year-to-date.

Europe’s Quiet Banking Crisis

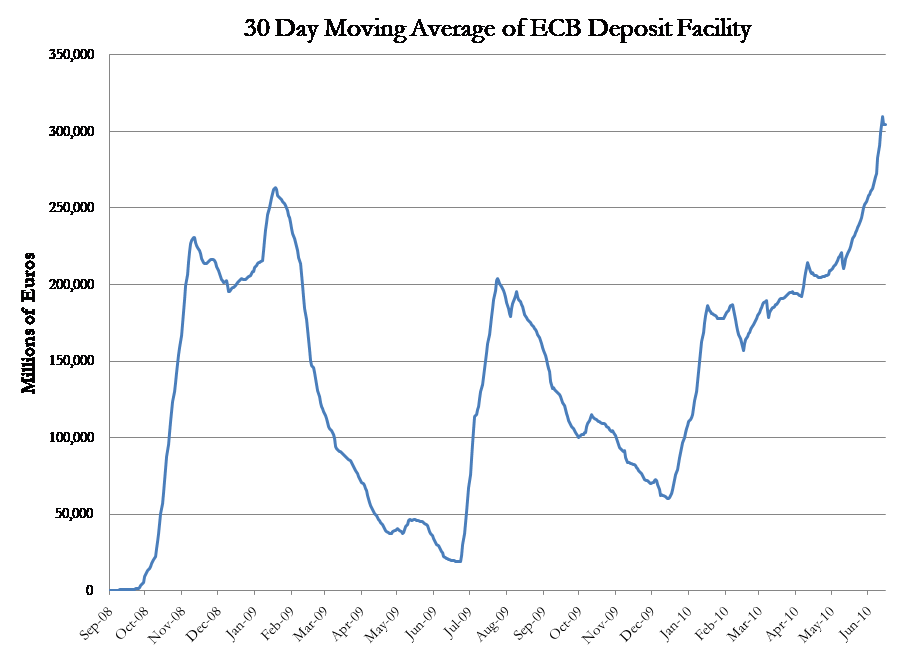

In recent months, many European banks have stopped lending to one another. The only visible sign of this crisis—a gradual rise in euro denominated interbank rates—belies the severity of the problem. As euro denominated interbank rates have edged up, a growing number of European banks have been unable to borrow at anywhere near the published rate, and many more have been shut out of the interbank market altogether. The stronger banks with excess liquidity are choosing not to tie their fortunes to their weaker peers and are quite sensibly holding their deposits directly with the European Central Bank (ECB)—a trend which has pushed overnight deposits at the ECB through their 2008 peaks (graph below).

As stronger European banks have closed ranks, the ECB has rushed into the breach providing short-term funding to weaker players. With so many European banks so poorly capitalized, the ECB is not willing to risk letting the market remove even the worst banks, fearing the process of culling the weakest might very well call into question the capital adequacy of the entire European banking system. If there is one question European authorities want to avoid, it is a generalized discussion of their banking system’s inadequate capital. Calling attention to this underlying problem might necessitate actually fixing it, which is an exceedingly expensive proposition. European banking system assets tip the scales at 375% of European GDP and rest atop tangible equity of just 3.5%. Even before the current crisis took hold, the Europeans have been consistent on this point, having recently thwarted a movement in the G20 for higher bank capital requirements.

Having short circuited market discipline and placing short-term stability above all else, the ECB needs to counter the perception that it has become just another money printing central bank. Some discipline must be placed on the banking system—just not too much of it. It is in this context that various European authorities have revived bank stress tests, hoping that if the stress tests are sufficiently credible, the market may not conclude that the ongoing bailout is irresponsible in its unlimited scope and size. Given our recent experience with bank stress tests here in the United States, we would be deeply surprised to see a sufficiently credible or even a timely version of these tests in Europe.

While the ECB will almost surely be successful in its proximate goal of avoiding a banking panic and preserving market stability, this victory will come at a great cost. First, there are the immediate problems associated with government officials instead of the market deciding which banks will survive and which will fail. The process will inevitably be political and drawn out. Governments will seek to remove as few weak links as possible, thereby minimizing the direct fiscal cost. The result will be a European banking sector that remains undercapitalized and unreliable as a capital allocator for a long time to come.

The larger cost will be the ECB’s credibility. As recently as April, the ECB could lay claim to being one of the very last developed market central banks pursuing orthodox policy. Consequently, there was still some hope for sound money in Europe in the long-run. But following the ECB’s dramatic spring reversal regarding the extent of its intervention into the banking system and government bond market, their credibility has been compromised. The ECB, like all developed world central banks, is in charge of stability because the European banking system can’t handle anything else. The Euro, never having really achieved reserve currency status, will almost certainly never do so now. More importantly from our perspective, the long-term damage done to what may have been gold’s most viable paper money competitor, has had the effect of reaffirming gold’s unique position as the one currency a central banker cannot print. Equinox continues to be heavily leveraged to the remonetization of this rare metal.

Laying the Groundwork in America

We do not own a single US company, and it has been a decade since we have had more than a small long position in the US. However, we are seriously looking at US businesses again because despite America’s well known macroeconomic problems, it is home to many of the world’s best businesses—some of which are already trading at reasonable multiples.

While we are unlikely to invest much capital in the United States prior to another financial crisis, we want to be prepared in case America’s macroeconomic situation deteriorates further and values become particularly enticing. Accordingly, we have begun a regimen of visiting businesses throughout the US and combing through US financial statements. Two things have struck us in this process. First, US commercial air travel is far and away the worst anywhere in the world. Second, and almost equally unpleasant, US accounting rules are incredibly complex and cumbersome to work with. Assuming you are already sufficiently well informed about the deplorable state of America’s domestic air travel, we will skip straight to the state of US accounting standards.

If only US GAAP, “Generally Accepted Accounting Principles,” were what they purported to be, that is “Generally Accepted Accounting Principles.” Instead, they might be more accurately described as US BEAR, “Busily Evaded Accounting Rules.” If you doubt this assertion about the rule-based nature of US GAAP, just scan your favorite Financial Accounting Standards Board (FASB) Standard for the words “if” and “unless”, and such phrases as “in the case of” and “except for,” all of which are dead giveaways of a rule- based approach.[1] As to the idea of GAAP being generally accepted, this too seems at odds with some of the evidence. If they were generally accepted at a fundamental level, they would not need to be endlessly reworked in an effort to stave off evasion.

The endless cycle of ever more complex rules and ever more clever evasion has rendered US GAAP not particularly useful to investors, mind-numbingly complex, and clearly inferior to the principles-based approach that we find elsewhere around the world. While we will refrain from claiming a golden age of accounting ever existed here in the States, we do believe that US GAAP was not always the misnomer that it has now become. The descent from principles to rules which began in the 1960’s was greatly reinforced after the Securities and Exchange Commission (SEC) designated FASB the sole private standard setting body in 1973. This designation—made in the name of independence—further insulated the standards from the principal creators of financial statements, namely public companies themselves.

Freed from one set of interests, America’s accounting standards quickly fell victim to other influences, namely those of the auditors and the regulators. Auditors and regulators saw benefits in a move to a rule-based system. The auditors favored rules because rules protected their firms from liability and the SEC supported rules in order to make enforcement easier. As a result of these newly influential interests in the 1970s, FASB began providing bright lines characteristic of a rule-based approach. The fundamental nature of this change was quickly recognized by academic accountants who bristled at the position to which their profession was being relegated. Distinguished professor of accounting, Abe Briloff, described the evolving system as, “one in which accountants would show their sophistication in the complexity of their models and not the wisdom of their judgment.”[2]

This movement to rules and away from principled judgment was vigorously justified: rules are less arbitrary and less subjective than principles. While the cost of this increased clarity was complexity, it was argued that complexity was less dangerous than the arbitrary enforcement of principles. This was a theoretically plausible argument that has simply not proven true in practice. In reality, rules have not led to clarity; they have led to gamesmanship:

[A]n aggressive company’s management engages in a transaction not covered by specific accounting rules, accounts for it as it chooses, and challenges the auditor by arguing, “Show me where it says I can’t.” The auditor used to be able to appeal to first principles of accounting… Now, the aggressive management can say, “Detailed accounting rules cover so many transactions and none of them cover the current issue, so we can devise accounting of our own choosing.” And they do.[3]

While the dominant trends in US accounting over the past half century have been regrettable, we are somewhat hopeful that the global ascendance of International Financial Reporting Standards (IFRS) offers America a way back to principles. While we will be the first to admit that IFRS is far from perfect—and it is itself moving in the direction of rules—it would still be a huge improvement over US GAAP. Furthermore, with more than 100 countries on IFRS, we are hopeful that IFRS will prove somewhat insulated from any one regulator or lobby and consequently never be reduced to a game of “show me where it says I can’t”.[4]

Conclusion

With our holdings in companies in emerging markets accounting for more than half of our partners’ capital, it may seem curious that we have spent the entirety of our quarterly letter addressing issues in the US and Europe. Accordingly, we want to reiterate our enthusiasm for our portfolio of superior operating businesses that continue to generate strong growth and trade at just 9.5 times next year’s earnings. We also remain thoroughly pessimistic about the macroeconomic situation in the developed world. That said, we are busily preparing for the time when our view of the world becomes accepted wisdom. In such an environment, we will likely have an opportunity to burnish our contrarian credentials once again.

Sincerely,

Sean Fieler William W. Strong

President Chairman

END NOTES

[1] Paul Miller and Paul Bahnson, “The Spirit of Accounting”, November 19, 2009.

[2] Abe Briloff, “The Reprofessionalization of Accountancy”, Speech given to the Michigan Association of CPAs and The Graduate School of Business Administration, Michigan State University, May 24, 1983.

[3] Roman Weil, “Fundamental Causes of the Accounting Debacle at Enron: Show Me Where It Says I Can’t”, Summary of Testimony for Presentation 06-Feb-2002 The Committee on Energy and Commerce, February 6, 2002.

[4] Ibid.