Kuroto Fund, L.P. - Q3 2012 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Kuroto Fund rose +10.1% in the quarter ended September 30,

2012. After gains in October and in November, the fund was up +19.6% for the year to date through November 30th. This compares to the MSCI Asia Pacific index which was up +12.7% during the same period.

JAPAN'S NEW RADICALS

A government persistently spending almost twice what it collects in tax receipts perfectly instantiates Herb Stein’s famous law: “If something cannot go on forever, it will stop.” Mindful that this is the perennial Western reaction to so much of what goes on in Japan, Kuroto undertook a study of the many levers the Japanese government can pull in order to continue postponing an eventual day of reckoning.

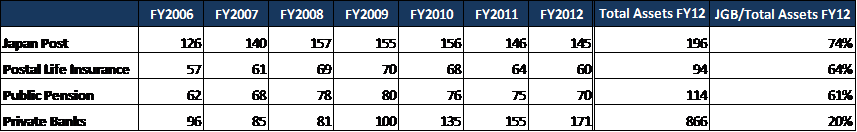

First amongst these levers are Japanese Government Bond (JGB) purchases by the parastatals— public pension funds and other quasi-government entities. While this had been an effective strategy for more than a decade, in recent years these parastatals have begun shrinking their balance sheets as Japan’s savings rate has declined with its aging population; they became sellers rather than buyers of JGBs. As a result of this change, the Japanese government began to lean more heavily on Japanese commercial banks to buy its bonds. In defending the 22% of his bank’s balance sheet currently invested in government bonds[1], the CEO of Bank of Tokyo-Mitsubishi could only offer that, “...we need to be responsible to keep that market in order.”[2]

More recently, as bank balance sheets have become increasingly laden with JGBs, a new, price-insensitive buyer was needed. Fortunately, the heretofore reluctant Bank of Japan (BOJ) has become a convert to monetary quantitative easing. Despite its vehement denials of “deficit monetization,” the fact is that Japan’s central bank has purchased 32% of all net JGB issuance in 2011 and 109% in the first six months of the current fiscal year 2012.

| FY 2005 | FY2006 | FY2007 | FY2008 | FY2009 | FY2010 | FY2011 | FY2012 6MONTHS | |

|---|---|---|---|---|---|---|---|---|

| JGBs outstanding | 671 | 674 | 684 | 680 | 720 | 759 | 789 | 804 |

| net change | 4 | 10 | (4) | 40 | 38 | 31 | 14 | |

| BoJ JGB Holdings | 93 | 76 | 67 | 64 | 73 | 77 | 87 | 103 |

| net change | (17) | (9) | (3) | 9 | 4 | 10 | 16 | |

| % of JGBs purchased by BoJ | -475% | -89% | 81% | 22% | 11% | 32% | 109% |

Interestingly, rather than gloss over their central bank’s balance sheet expansion—as America’s leaders have—Japanese politicians are demanding even more. The current Prime Minister, Yoshihiko Noda, has openly embraced further easing. Moreover, Shinzo Abe, head of the Liberal Democratic Party (LDP) and the lead contender to replace Mr. Noda, has been even more aggressive, declaring that, “we should set an inflation target and print unlimited Yen until we reach that target.” [3] To hammer home this point, Mr. Abe has promised to work closely together with the BOJ governor to achieve this target.

This fervent easy money rhetoric strikes us as more than just an effort to secure a reliable buyer for JGBs or to talk the Yen lower. It seems instead to be an effort to blunt the nascent movement in Japan for real political reform, a movement that is gaining momentum as the Japanese economy enters its third decade of listless growth.

If Japan’s economy suffers from sclerosis, the only word that describes its politics is stasis. The LDP has had one of the longest runs in power of any political party anywhere in the democratic world. Since its inception in 1955 until 2009, the LDP was in power for all but 11 months of those 54 years. Even the 2009 electoral win by the Democratic Party of Japan—the main opposition party—did not create any real change in the country, as their policies have ended up being very similar to those of the LDP.

A major reason for this lack of change in the face of decades of economic deterioration is due to the fact that the real reins of power in Japan are held by the unelected bureaucracy. Under the LDP’s long post-war tenure, the Japanese bureaucracy arrogated enormous powers to itself. With most Japanese legislation and all budgets originating in the Japanese bureaucracy, the bureaucracy has far more power than the politicians in most policy debates. Needless to say, the bureaucrats are loathe to allow bureaucratic reform which is exactly what the newly created Japan Restoration Party (JRP) is proposing. It is against this political backdrop that inflation targeting—a change that won’t force the Japanese elite to amend their ways—has gained such political support from bureaucrats and politicians alike.

Over the last few months, this cozy political party duopoly overseen by the powerful bureaucracy has witnessed the development of a serious reformist threat from the JRP founded by Toru Hashimoto. When it comes to dealing with the bureaucracy, Mr. Hashimoto, the youthful leader of the JRP and current Mayor of Osaka, has made his agenda clear. In his current position, he has cut public sector pay and forced performance requirements on school teachers. The JRP manifesto for the upcoming election even calls for a “Great Reset” of Japan’s existing social system. They want to change from a centralized power-state model to a regionalized power-state model, extend nationwide the civil service reforms implemented in Osaka, abolish the Diet Upper House, and allow the popular election of the Prime Minister.

In response to this unwelcome political threat, the long-established elite’s views on proper monetary policy have taken a radical turn. This shift is as evident in the bureaucrats as in the politicians. For example, the four leading candidates vying to replace BOJ Governor Masaaki Shirakawa have each championed inflation targeting, and Mr. Abe, the likely winner of Sunday’s election, has floated the idea of formally changing the BOJ’s statutory mandate.

Importantly, the election will not prove to be the high-water mark of Japan’s inflation targeting as we think that Mr. Abe and the BOJ will actually follow through with their attempt to create inflation. This represents a substantial departure from the past twenty years of Japanese economic history, and should represent a propitious time to be short overpriced Japanese government debt.

Japan’s decision to aggressively ease on the back of expansionary fiscal policy raises the ultimate probability of both falling bond prices and a weakening Yen. Both seem likely to us, but we continue to believe the bond market offers the superior short opportunity due to the asymmetry of shorting low-yielding bonds. Accordingly, we’ve maintained our outsized short exposure to Japanese government debt via interest rate swaps and low-priced swaptions.

Sincerely,

Sean Fieler

Daniel Gittes

William W. Strong

ENDNOTES

[1] Bank JGB bond exposure taken from Mitsubishi UFJ Financial Group Q2 2012 Report.

[2] Patrick Jenkins and Michiyo Nakamoto, Japan bank chief warns on bond exposure, Financial Times, December 2, 2012.

[3] Alexander Martin, Japan Opposition Leader Ups Pressure on Central Bank, Wall Street Journal, November 14, 2012.