Kuroto Fund, L.P. - Q1 2012 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Kuroto Fund rose +13.8% in the quarter ended March 31,

2012. After losses in May, the fund was up +4.3% for the year to date through May 31st. This compares to the MSCI Asia Pacific index which was up +0.1% during the same period.

...when others are fearful

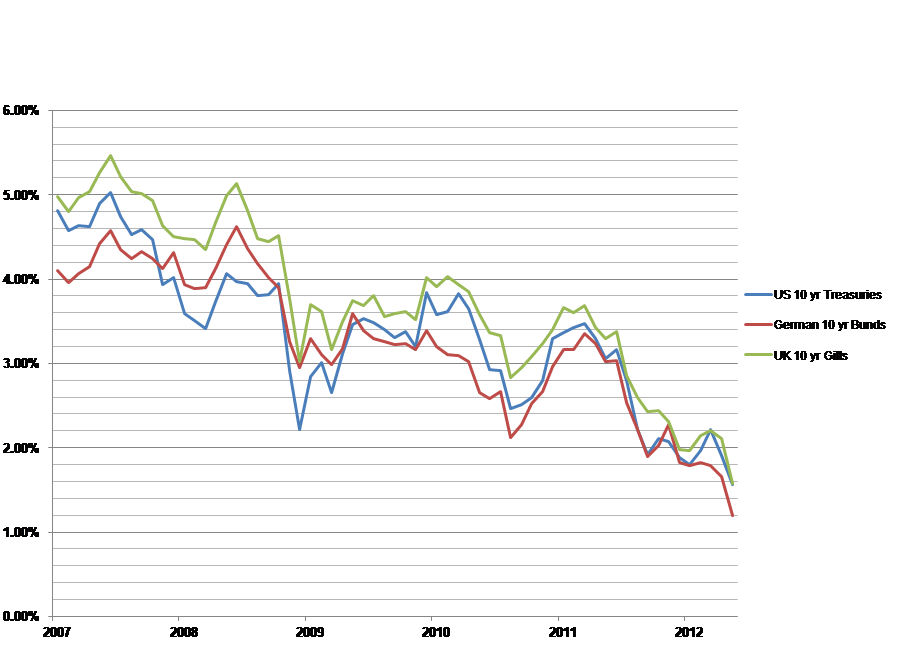

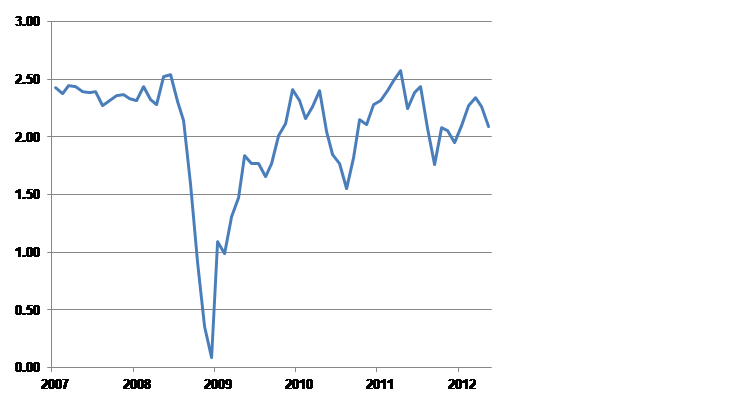

The severity of the current iteration of the “risk-off” trade, as illustrated in the bond yields above, is historic. Yields are now much lower than in even the darkest days of 2008-2009. Contrary to conventional wisdom, however, these current extremes are not the result of a renewed fear of deflation. In fact, inflationary expectations, as measured by the gap between yields on conventional 10 yr Treasuries and TIPS, remain range bound.

Not only has the justification for ever lower bond yields changed but the buyer has changed as well. Households, not central bankers, have been the principal purchasers of government bonds lately, buying nearly $200 billion of US Treasuries in the first quarter of this year, more than both foreigners and the Fed.[1]

The triumph of emotion over reason is leading to the increasingly indiscriminate valuation not just of government bonds, but of operating businesses as well. While in the aggregate our operating businesses are trading at an attractive, but unspectacular, multiple of eleven times this year’s earnings, the disparities in their valuations have risen dramatically as stock prices have moved wildly on incremental news.

Against this backdrop of volatile, less-discriminating markets, our value-based approach is providing a multitude of opportunities. We’ve been buying great financial franchises at high single-digit multiples to earnings while simultaneously selling consumer products companies near their all-time highs. More specifically, for the year to date through June 15, we’ve bought $23 million of superior operating businesses in India and $17 million in Japan, and have increased our exposure to undervalued gold mining companies and gold bullion by $15 million. We have funded these purchases with sales of $28 million in the Philippines, $15 million in Indonesia, $6 million in Thailand and $4 million in Singapore. Of particular note are the superior Indian businesses which we have been buying at increasingly attractive prices. Not coincidentally, the India investment opportunity is now widely criticized—a topic to which we devote the balance of this letter.

India: The Bad, The Good and The Opportunity

The Bad

As economic reform fell victim to a seemingly endless stream of political compromises, we reassured ourselves that the Indian economy would grow at night while the government slept. So long as the status quo was maintained, we reasoned, India might not achieve its full potential but would nonetheless continue to grow rapidly. Indeed, over the past eight years, Indian GDP did grow at an average rate of 8.3% annually. Recently, however, this strong-growth-no-reform status quo unraveled as the Indian government began actively inhibiting growth rather than merely restraining it.

A peculiar combination of anti-corruption zeal and tentative political leadership paralyzed the Indian bureaucracy, a paralysis which in turn disrupted the Indian capital expenditure cycle. Fearful of prosecution and lacking political direction—not to mention the bribes that have long lubricated the system—Indian bureaucrats have been opting for inaction. This inaction has derailed a multitude of investment projects requiring government approval. While India hasn’t quite returned to the complete paralysis that preceded Prime Minister Singh’s dramatic laissez-faire measures as Finance Minister in the early 1990s, the costs of governmental paralysis can no longer be ignored.

Egged on by the global intolerance for uncertainty, markets have responded swiftly to India’s bureaucratic paralysis. The India rupee has depreciated 13% since the beginning of March, foreign portfolio flows have ceased and India’s hard won investment-grade rating is openly being questioned. Either Prime Minister Singh and Congress Party Chair Sonia Gandhi will take steps in the right direction or markets will continue to punish India.

The Good

Since its peak over four years ago, the Indian stock market, as measured by the SENSEX, has declined over 15% in rupee terms. Over that same period, the SENSEX’s earnings have risen 32%, implying a nearly 50% reduction in valuations.

These now cheaper Indian businesses are also denominated in an increasingly attractive currency. The low level at which the Indian rupee currently trades on a purchasing power parity basis (i.e., the exchange rate at which similar goods in two different countries would be equivalent in price) suggests considerable long-term upside in the Indian rupee if India can contain its fiscal and current account deficits. On both of these fronts there is good reason to be optimistic.

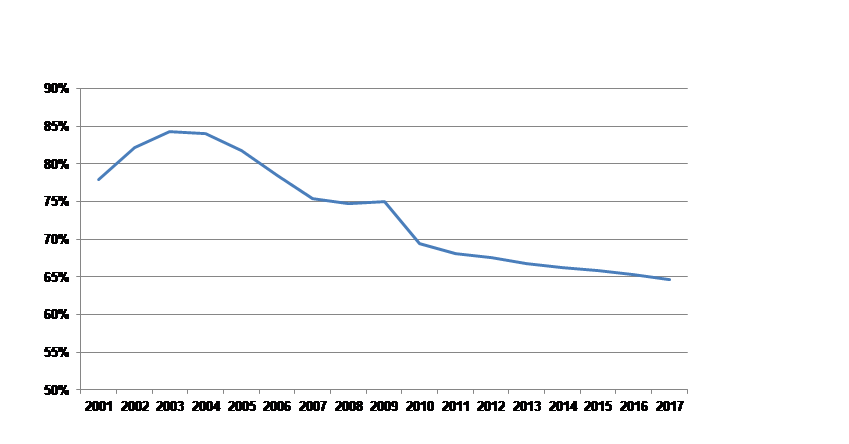

India’s 5% to 6% fiscal deficits in combination with annual nominal GDP growth of more than 10% have resulted in a steadily declining debt-to-GDP ratio as shown in the following graph. While an almost six percent fiscal deficit is not to be commended, this fiscal result is clearly sustainable and puts India in a better position than most of the rest of the world.

A sustainable level of debt characterizes not just India’s public sector but its private sector as well. With public plus private debt to GDP in India still at a comparatively low 122%, the Indian economy remains free from the principal problem weighing on the economies of the developed world.

Finally, India’s current account deficit of 3.6%, while a constant source of concern, also remains contained. Net of hydrocarbon imports totaling five percent of GDP, India would actually run a meaningful current account surplus. Moreover, India’s own natural gas resources are large enough to allow the country to wean itself off of hydrocarbon imports completely. Indian regulators, to be clear, are doing their best to deter the development of India’s local petroleum resources, as seen in the ongoing pricing dispute with Reliance/BP over the potentially huge D-6 gas field. But, even while Reliance and others are currently directing their capital elsewhere, India’s huge, still untapped resources promise to provide significant support to the Indian current account, and consequently the rupee, over time.

The Opportunity

While it is difficult to look through the incessantly negative headlines about India and clearly see the attractive investment environment in which better businesses will grow for many years to come, Indian stock prices are providing a strong incentive to look carefully. Moreover, it appears that Prime Minister Singh will have an opportunity to restore his tarnished image as a reformer. Following the appointment of Finance Minister Pranab Mukherjee to the largely ceremonial office of President, Prime Minister Singh will assume direct charge of economic policy making. If in his new capacity as acting Finance Minister, Prime Minister Singh can deliver on long-delayed but much-needed reforms, such as retail liberalization and pension restructuring, he will succeed in both reviving his image as a reformer and putting India back on a promising development trajectory.

Our sizeable portfolio of superior Indian businesses (21% of partners’ capital) currently trades at just ten times this year’s earnings with a few of our favorite Indian financial franchises trading at mid single-digit earnings multiples. We have been enthusiastically taking advantage of the current buying opportunity to increase our ownership of these great businesses at very attractive valuations.

Organization

After more than seven years with Kuroto Fund, Isuru Seneviratne and his family have decided to move to Isuru’s native Sri Lanka. Isuru, long having expressed an interest in returning to Sri Lanka, gave us ample time to train other analysts to assume his coverage in mining and energy. We will miss Isuru’s presence a great deal and we look forward to working with him on a consulting basis.

Sincerely,

Andrew Ewert

Sean Fieler

Daniel Gittes

William W. Strong

ENDNOTES

[1] James Bianco, June 15, 2012. What Is A “Household” And Why Are They Buying Treasuries? http://www.ritholtz.com/blog/2012/06/what-is-a-household-and-why-are-they-buying-treasuries/ . “According to the flow of funds categorization, households are simply a residual category for all the net purchases which do not fit into one of the Federal Reserve’s other pre-defined categories.”