Equinox Partners Precious Metals, L.P. - Q1 2020 Letter

Dear Partners and Friends,

Top-five holdings Coronavirus update

Pan American Silver: Market Cap: $3.4b / Net Debt: $78m

All of Pan American’s mines except for Timmins (about 6.5% of NAV) have been placed on care & maintenance due to the coronavirus, and the company has pulled production/cost guidance for the year. With net debt of $78m, $240m available on its credit facility, and no significant capex projects planned for this year, Pan American can navigate the current environment without much trouble. The management team has taken a 20% reduction in salary in a show of solidarity with their employees who are currently being paid their base salary.

2019 was a transformative year for Pan American with the closing of the Tahoe transaction and the release of an initial resource for the polymetallic skarn deposit at its La Colorada mine. The company reported an initial inferred resource at La Colorada of ~73 million tonnes, which we value at ~$1B. During Q1 2020, the company released additional drill results for the skarn deposit which were higher grade than the inferred resource, suggesting the skarn will continue to grow and its economics improve.

With a strong balance sheet and nine silver mines in five countries in the Americas, Pan American is well positioned to weather the current storm and benefit from higher silver prices going forward. With over one-third of the world’s silver supply currently offline and investor demand for silver surging, we expect silver prices to rise in the near future.[1]

MAG Silver: Market Cap: $741m / Net Cash: $72m

We’ve pushed our estimate of MAG’s production startup out 6+ months, to the first half of 2021. All the equipment necessary for construction is on site and the joint venture’s construction crews were still working as of April 5th. That said, we believe that there is good reason to expect a delay in the construction given the logistical challenges posed by the coronavirus.

The delay in construction will slow the rate at which MAG spends its remaining cash. The company had USD$72m in cash as of Dec 31. We expect MAG will need an additional USD$50m in the next twelve months due to cost overruns plus another year of G&A. MAG will likely borrow these additional funds in the second quarter when its construction timeline is clarified.

Our estimates for the joint venture once it begins production remain unchanged. Tonnage will begin at 4,000 tonnes per day (tpd) and increase to 8,000 tpd within a few years of initial production. At 8,000 tpd, the JV will have a stated mine-life in excess of 12 years and a functional mine-life of much longer. The JV has increased its exploration budget to $5m to build on the promising results in late 2019. We expect the JV will identify another mine on the property in the next few years.

At $18 silver and 4,000 tpd, the JV generates a 44% IRR with a cash cost of ~$5 per ounce of silver. At 8,000 tpd, the project’s IRR rises, the cash cost falls, and MAG’s portion of the JV’s free cash flow tops USD$100m per year and generates a FCF yield in excess of 13%. In the first year of commercial production, we anticipate that the JV’s free cash flow will be reinvested in the expansion to 8,000 tpd. After that expansion, we expect MAG’s board to either reinvest the company’s free cash flow into high-return projects on the JV property or to return the free cash flow to shareholders via dividends and share buybacks.

Sandstorm: Market Cap: $982m / Net Debt: $0m

We expect Sandstorm to be profitable in the second quarter despite the halving of its revenue due to mine shutdowns. Within its portfolio, the most notable suspensions and reduced operations are Yamana’s Cerro Morro, Lundin Gold’s Fruta Del Norte, and First Majestic’s Santa Elena. Assuming a 3-month stoppage at the affected mines, 12.5% of Sandstorm’s 2020 attributable production will be shifted to future years. Accordingly, we’ve reduced our estimate of Sandstorm’s free cash flow to just $7m for the quarter.

With ~$300m USD in credit lines available and no debt, Standstorm has an opportunity to acquire incremental assets at attractive prices given the current stress in the mining sector. Sandstorm has also just renewed its stock repurchase program. The company repurchased 3.7m of its own shares during the market volatility in March. Either through acquiring royalties at a great price or buying its own undervalued portfolio through share repurchase, Sandstorm has the ability and the willingness to grow value for shareholders. We expect CEO Nolan Watson and his team to consummate at least one opportunistic deal in the next few months.

Longer term, we believe that the market is making a mistake by not attributing any value to Sandstorm’s 30% equity stake in the Hod Maden mine in Turkey. When Hod Maden goes into production, currently scheduled for the fourth quarter of 2022, we expect the asset to almost double Sandstorm’s cash flows.

Dundee Precious: Market Cap: $680m / Net Cash: $50m

With no large capital requirements, no net debt, and Ada Tepe’s ramp up complete, Dundee Precious Metals is in a very favorable position. We estimate that they exited Q1 with a $50m net cash position. The company’s coronavirus impact has been minimal: both of its mines continue to operate without interruption, while the smelter is still running at ~80% of its current capacity. As a result, the company is on track to generate in excess of $175m in operating cash flow in 2020.

Dundee Precious Metals is also well positioned to acquire another company for a bargain price or to acquire a meaningful amount of its own shares. Either option should benefit shareholders materially. For the share buyback to be effective, the company will need to make a tender offer. They could do so for up to 25% of the shares outstanding and still exit the year in a net cash position. As for acquisitions, the company has been reviewing targets for more than a year. The pricing for such an acquisition is obviously more favorable now. We believe that either buying back stock or making an acquisition would be wise in the current environment. The mistake would be to do neither.

CEO Rick Howes is scheduled to be replaced in May at Dundee’s AGM by COO David Rae. David is sharp, competent, and offers Dundee operational continuity that is especially important in these more uncertain times.

Goldmoney: Market Cap: $130m; Net Cash $51

Goldmoney is one of the obvious beneficiaries from the stress in the physical market for gold and silver. With retail investors unable to purchase physical coins at reasonable premiums, and growing uncertainty surrounding the physical backing of the gold and silver ETFs, Goldmoney’s user-friendly physical storage services for gold and silver bullion around the world are poised to benefit.

The Goldmoney’s portfolio consists of four principal businesses: Goldmoney.com, Mene, Schiff Gold, and a gold-lending platform. Goldmoney.com is a precious metals holding platform which allows customers to buy and take delivery of physical metals in secured locations for a lower cost than coins or ETFs. Mene crafts pure 24-karat gold and platinum jewelry that is sold by gram weight with a 20-30% premium. These are, in effect, gold investments in the form of jewelry. Schiff Gold is a U.S. dealer of physical metals in the form of bars, coins and wafers. Finally, Lend & Borrow Trust is an online lending platform that enables peer-to-peer lending and borrowing collateralized by precious metals.

Goldmoney’s CEO, Roy Sebag, who began his carrier at Paypal, has spent the last four years building Goldmoney’s retail transaction platform. While the regulations allow for such a business to work in theory, in practice the regulators in both the U.S. and Canada stopped Roy from developing a gold-transaction business. Accordingly, Goldmoney has stopped investing in its transaction business and refocused on building its gold and silver investment businesses.

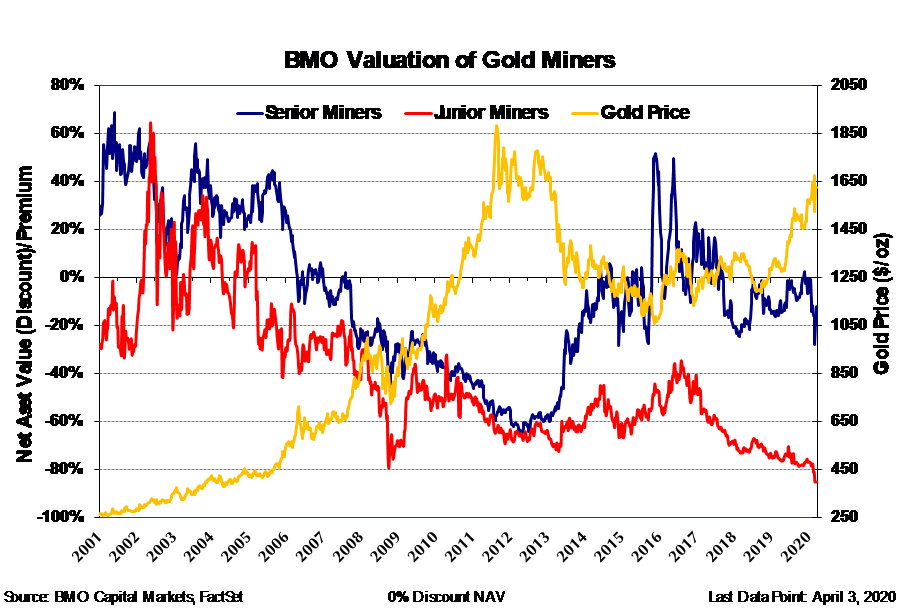

p/NAV of Gold miners

In the first quarter of 2020, gold prices were up and the price of gold mining companies were down. BMO’s long-term graph of the P/NAV (with a 0% discount rate) for their coverage universe of senior and junior producers provides a sense of how depressed today’s valuations are. As the graph shows, seniors which traded at a ~50% premium to NAV after the lows of 2015, are now trading at a meaningful discount to NAV, while the juniors are trading at an unbelievable 80% discount to NAV. The gold price and mining valuations are clearly disconnected, especially for the juniors that have traded at an increasingly large discount to NAV as the gold price has risen in recent years. The current combination of strong gold prices and low prices for gold mining companies presents an opportunity to invest in the space at a time when its underlying fundamentals are very strong and valuations are low.

mine closures

“296 mines globally have been temporarily shut down due to the corona virus as of April 6th. 178 (60%) are precious metal operations,” according to fund manager Marin Katusa. These closures have impacted our portfolio unevenly. Broadly speaking, our operations in Australia, Bulgaria, Ontario, Sweden, and West Africa have fared the best so far. We are also witnessing a number of exceptions on a mine-by-mine basis. MAG Silver’s construction site, for example, was still in operation through April 6th, despite the shutdown of most mines in Mexico.

We expect the broad restrictions on mining activity to be lifted in May and June, with the specific timing of the restarts varying from country to country. We are encouraged by the restart of some refining capacity in Switzerland, and we have yet to hear of companies being unable to monetize the metal they produce.

abnormalities in the gold market

“Some dealers are desperately contacting clients to see if anyone is willing to sell their gold bars and coins, and offering a rare premium over spot prices.”[2] Even at premium prices, there are few sellers of gold and silver coins into the retail channel. This has led to coin shortages and high premiums to spot prices. Current premiums for a one-ounce gold or silver round are over USD$100 for gold and over $5 for silver.[3] These premiums are a result of surging demand, low inventory and supply limitations caused by flight cancellations, and the widespread shutdown of precious metals refiners and mints.

The pricing discrepancies within the institutional precious metals markets are more difficult to explain and more important to understand. The most glaring anomaly is the differential between the COMEX future price and the spot LBMA price. This differential has remained large and volatile in April as other spreads in the capital market have normalized. Accordingly, there is growing speculation that the spread between COMEX gold and LBMA gold signals a deeper problem with the physical backing of these exchanges.

The LBMA issued two press releases last week to diffuse the situation. The market was not reassured: LMBA is trading at a $36 discount to COMEX gold as we write. With the LBMA holding over 8,326 tonnes of gold in storage (USD$407b) as of December 31, 2019,[4] the financial implications of this discount are non-negligible. Should LBMA gold continue to trade at such a substantial discount to COMEX, the credible allegations that the LBMA failed to fulfill some of its contractual obligations will gain additional credence.[5]

It is worth noting that the GLD and IAU ETFs are dependent on the performance of the LBMA and its sub-custodians. As such, questions about the integrity of the LBMA and its sub-custodians raise important red flags for the $80b+ of capital currently invested in gold ETF’s. Surprisingly, these two ETF continue to experience inflows. GLD alone has recorded estimated inflows of USD$3.9b since March 23rd.[6] Given the difficulties many have experienced sourcing physical gold recently, we are not alone in publically questioning these ETFs’ ability to successfully translate these massive dollar inflows into physical gold.[7]

Sincerely,

Sean Fieler

ENDNOTES

[1] Silver Shock Update, Jeff Clark, March 31, 2020

[2] Source: Bloomberg News.

[3] For example, the cheapest silver round at APMEX on April 7th trades at premium of $5.30/oz for a bulk 500-oz order of silver rounds, while their cheapest gold round enjoys a hefty premium of $178.

[4] Source: LBMA.

[5] Source: Numismatic News.

[6] Source: Reuters; Bloomberg data.

[7] Source: Bloomberg News.