Equinox Partners Precious Metals Fund, L.P. - Q2 2024 Letter

Dear Partners and Friends,

PERFORMANCE

Equinox Partners Precious Metals Fund, L.P. rose +2.1% in the second quarter, and is up +7.7% for the 2024 year-to-date through the end of June. Our portfolio of producing gold companies have been the primary drivers of contribution to return, while the early stage explorers and developers have traded down despite the rising metals price.

A breakdown of Equinox Partners Precious Metals Fund's exposures can be found here.

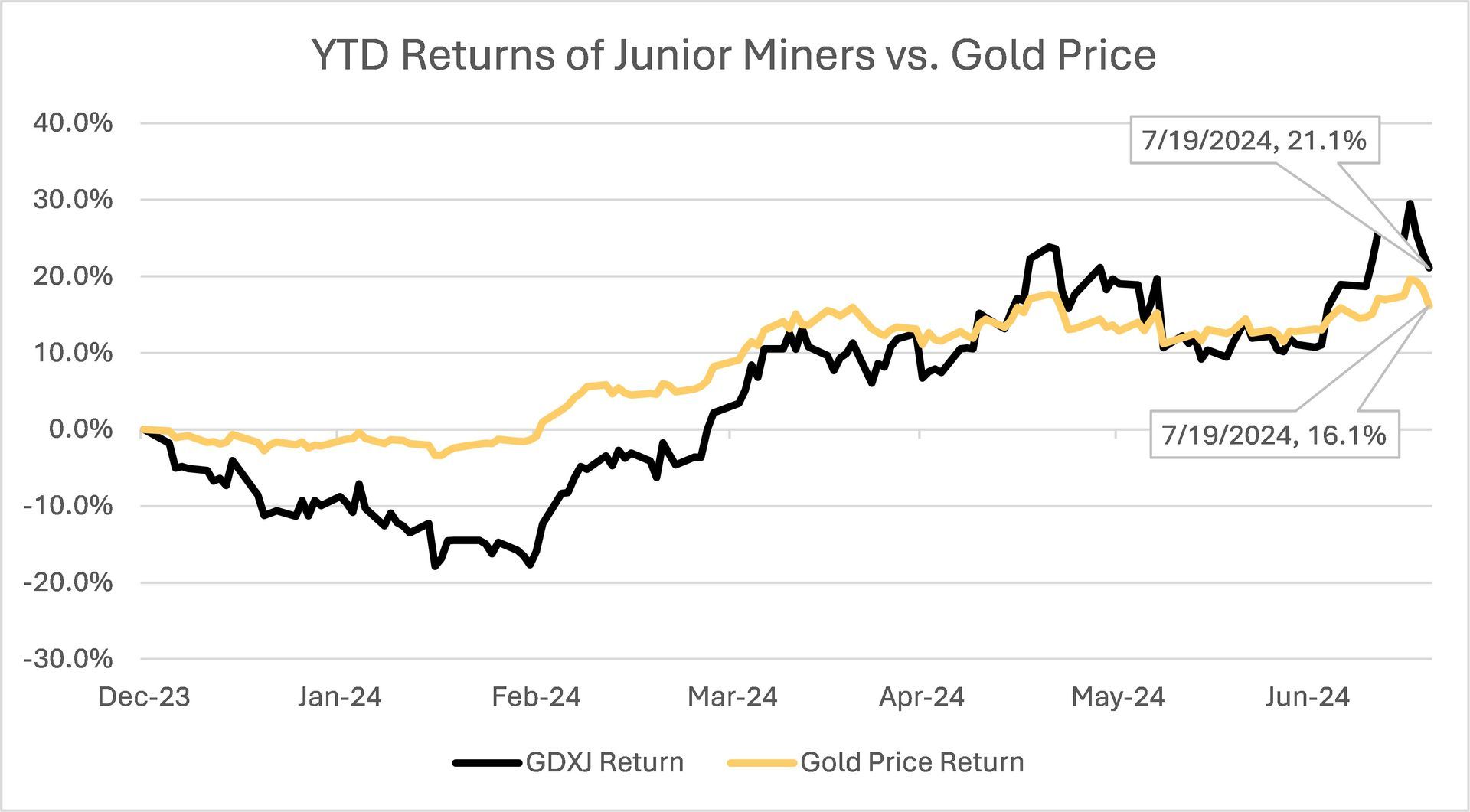

Gold Miners vs. Gold

Source: Koyfin; 2024 YTD Total Returns as of July 19th, 2024

After decades of underperformance, gold mining shares are finally showing signs of life. Gold mining indices are up 21% for the year to date as of July 19th, 2024, outperforming gold by 5%. This is a welcome change; it is also barely noticeable in the long-term graph of gold miners to gold.

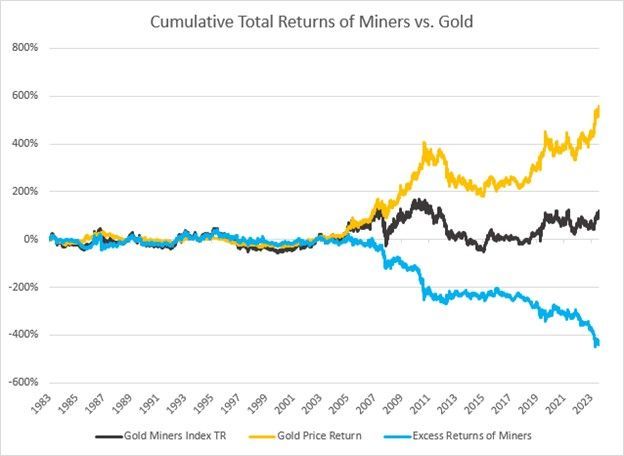

Source: Bloomberg; Bloomberg Gold Mining Index relative to Physical Gold Price, December 1983 to Present

The long-term underperformance of the gold miners is not only a long-term technical trend, but also a reflection of the failure of gold mining companies to generate meaningful additional free cash flow in a rising gold price environment.

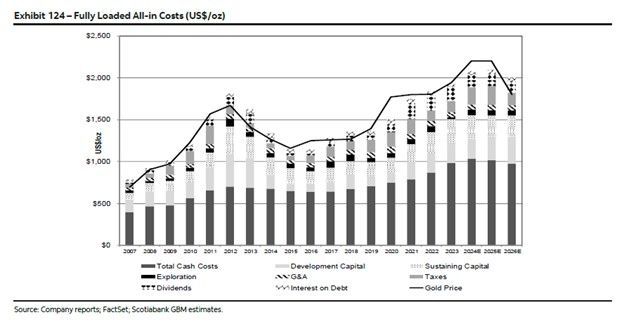

This failure can be visualized in the tight correlation between the gold price and the costs of mining gold. Since 2011 there has been a 93% correlation between AISC (All-In Sustaining Costs) and the price of gold.[1] Put differently, for more than a decade, any expansions of gold mining margins have been quickly eroded by the rising cost of gold mining.

[1] Equinox Internal Analysis of Mining AISC

Source: Scotiabank Gold Monthly Statistics Report. Data as of June 30, 2024

While some positive correlation between the gold price and AISC is to be expected, there is no fundamental reason for the correlation between the price of gold and the cost of mining gold to be as tight as it has been over the last thirteen years. After all, the vast majority of gold mining costs are tied to inflation, not the price of gold. Important costs such as labor, consumables, G&A, mine closure, new exploration and sustaining capital expenditure are not intrinsically linked to the price of gold.

Given the tight correlation between the gold price and gold mining costs over the most recent thirteen-year period, it is worth revisiting the periods where the price of gold and the cost of mining it meaningfully diverged. In the 1930s, the price of gold rose 69% and the price level fell 19%. In the 1970’s, the price of gold rose 14-fold, as the price level only doubled. Lastly, in the first decade of this century, the price of gold rose 6-fold as the price level increased merely 29%.

Each of these periods was particularly rewarding for gold mining investors, and each of these three episodes was very different. The 1930s divergence between the gold price and gold mining costs occurred during a deflation. The 1970s divergence occurred during a period of high inflation, and the 2000s divergence occurred during a period of low inflation. One notable common thread among the three periods is that the US government kicked off each gold bull market. In 1933, FDR revalued gold upwards from $20.67 to $35 the ounce. In 1971, Nixon unpegged the dollar from gold. In August of 1999, the United States hosted the Washington Agreement to limit central bank selling of gold.

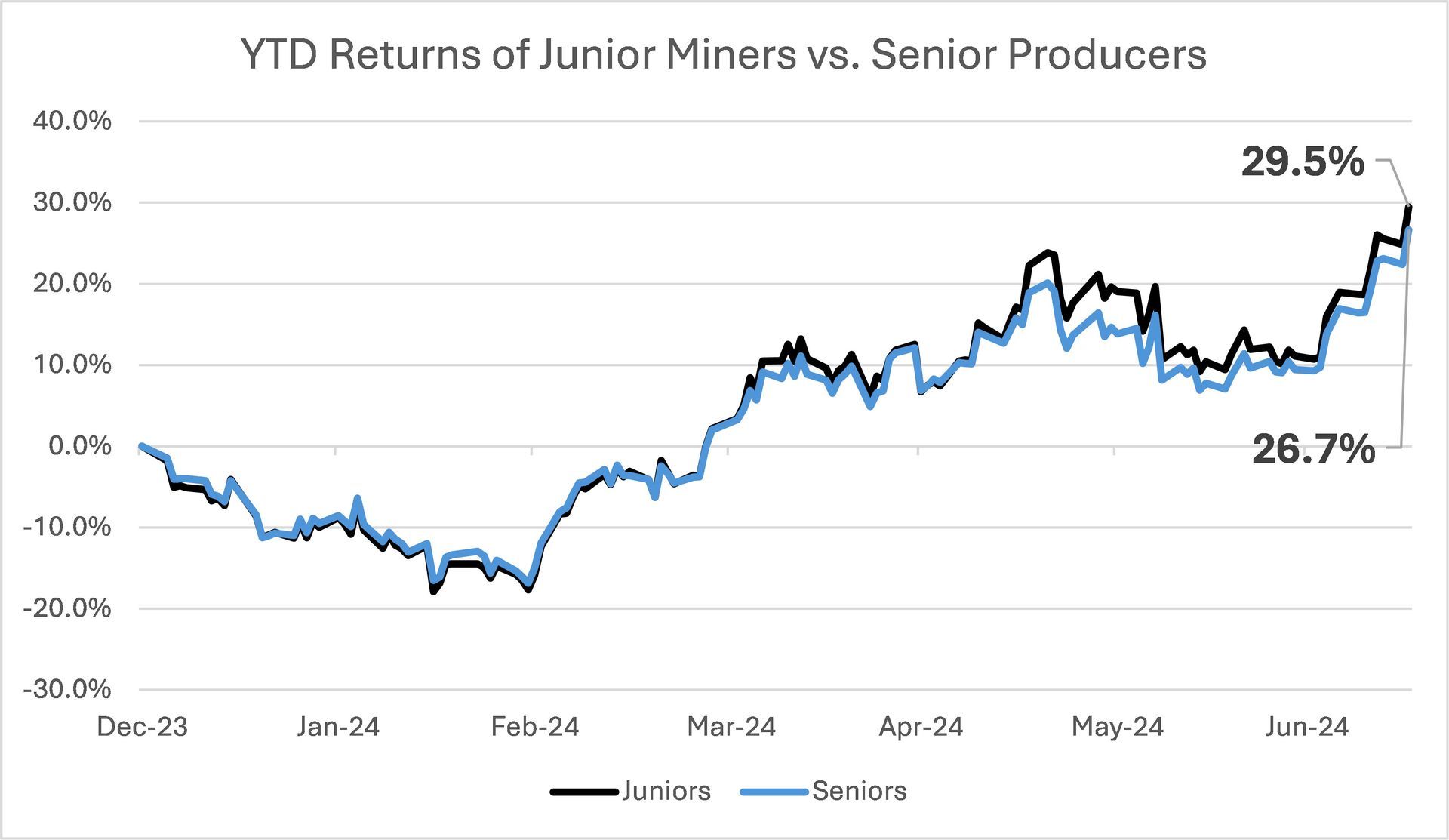

Given the United States’ current unsustainable fiscal path and rapidly deteriorating geopolitical position, we suspect another divergence of historic proportions between the gold price and AISC is in the offing. When this turn arrives, it should be particularly rewarding for the gold miners. At the margin, there are signs that this long-awaited turn is already underway. For one, smaller cap gold miners are starting to outperform the larger peers for the first time in years (see below). As this trend continues, we expect the deeply undervalued gold explorers will begin to sharply re-rate.

Source: Koyfin, As of July 16th 2024

mining Gold for Free Cash Flow

In periods in which AISC and the gold price are highly correlated, the correlation does not uniformly hold for all mines. Three factors in particular have helped us mitigate against the industry’s trend of rising mining costs: geology, vintage and location.

- There is no substitute for good geology. It is like good genetics. The best coach cannot make an average runner into Usain Bolt, and the best management team cannot make an average mine world class. While grade is the most important geological variable, other factors such as continuity, scale and rock geochemistry can all have similarly meaningful impacts on the mine’s AISC. As a rule, predictable ore bodies lend themselves to improvement, complex ore bodies do not.

- Newer vintage mines typically enjoy lower sustaining capital costs and lower staff turnover. New mines not only tend to operate more efficiently but also are better at retaining employees. This relationship can be seen in the data. From 1992-2023, AISC grew at an average rate of 5.3% for the 400 companies in our internal database. For the 240 mines in our dataset that began operations after 1992, they averaged just 2.4% growth rate in costs over the first four years of operation, suggesting a honeymoon period for new mines during which their costs tend to be more stable.

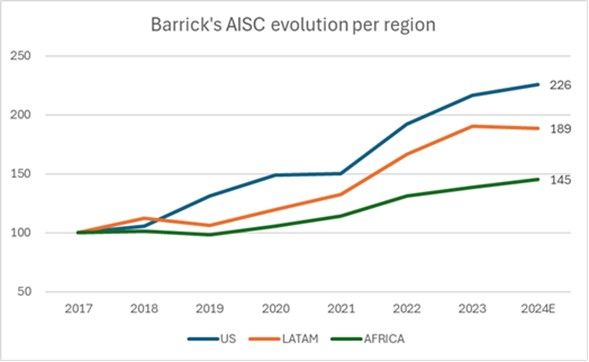

- Francophone West Africa’s mines have experienced significantly less cost inflation over the past two decades. Not only have they enjoyed a stable currency and low rates of inflation, but they also have structurally lower labor costs. Whereas a typical North American mine spends 30% of its annual budget on labor, a typical mine in French West Africa spends closer to 10% on labor. Barrick’s AISC breakdown since the acquisition of Randgold illustrates this distinction nicely. Since 2017, costs at Barrick’s U.S. operation rose 126%, while costs at their African operations have increased just 45%.

Source: Barrick Financial Reports, Equinox Internal Analysis. Indexed to 2017 Levels

conclusion

The Equinox Partners Precious Metals Fund, L.P. is concentrated in companies with quality assets that can improve margins as the gold price appreciates faster than inflation. This strong quality bias in our stock selection has helped us generate a modest, but positive, compounded annualized return in a historically difficult and declining equity market for gold mining companies. If we experience a structural divergence between the gold price and AISC like we saw in the 1970s and again in the 2000s, our producing company free cash flow growth will accelerate and our smaller companies that are asset rich and cash poor should re-rate dramatically.

Sincerely,

Equinox Partners Investment Management

[1] Please note that estimated performance has yet to be audited and is subject to revision. Performance figures constitute confidential information and must not be disclosed to third parties. An investor’s performance may differ based on timing of contributions, withdrawals and participation in new issues.

Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, FactSet or independent sources. Values as of 6.30.24, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notice.