Equinox Partners Precious Metals Fund, L.P. - Q1 2024 Letter

Dear Partners and Friends,

PERFORMANCE

Equinox Partners Precious Metals Fund, L.P. rose +5.6% in the first quarter.

A breakdown of the fund’s exposures and contribution can be found here.

1972 Redux

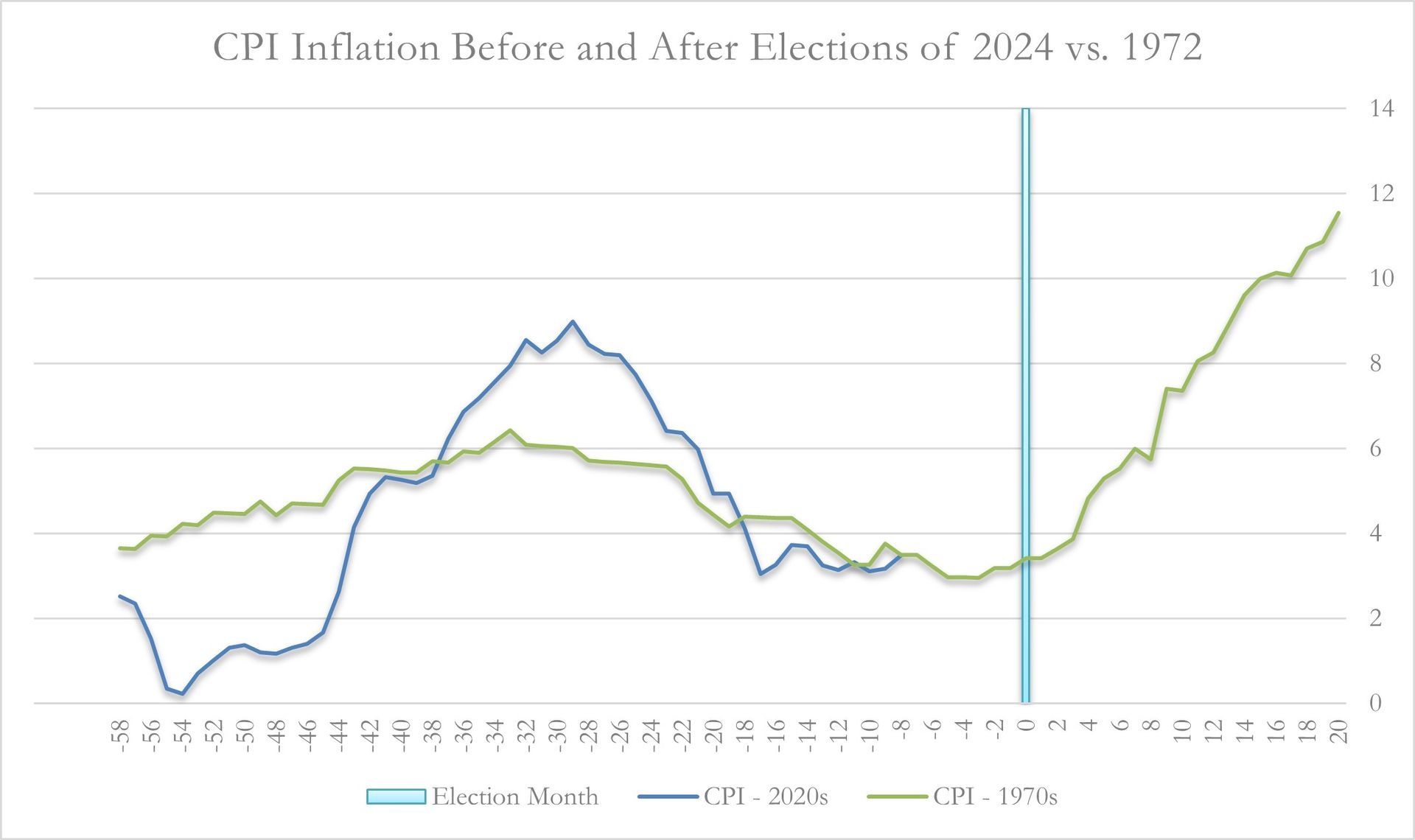

President Nixon famously pressured Fed Chairman, Arthur Burns, to run the economy hot going into the 1972 election , arguing that his opponent, George McGovern, posed a threat to democracy. If McGovern wins, “this will be the last conservative administration in Washington” claimed Nixon. Arthur Burns did run the economy hot in 1972, and Nixon was reelected, wining 60.7% of the popular vote and carrying every state except Massachusetts. The consequences of the Fed’s loose monetary policy were disastrous. The US stock market peaked a month after the Presidential vote on January 11th, 1973, and the S&P declined 45% over the following 21 months (53% in real terms). Inflation remained problematic for a decade.

President Biden, like Nixon, claims that his opponent poses a threat to America’s system of government. “Democracy is on the ballot,” intones Biden. We don’t know if Chairman Powell shares President Biden’s view, but it appears Powell is going to let inflation run hot into our November election. Like Arthur Burns 52 years ago, we think Powell’s passive approach to a lingering inflation problem is likely a prelude to a post-election spike in the price level.

Similarities, Differences and Consequences

The topline similarities between the inflation level and policy rates in 1972 and 2024 are striking. In both periods, inflation remained stubbornly above 3% after peaking a few years earlier in the high single digits. In both cases, the Fed kept policy rates between 5¼% to 5¾%.

Source: FactSet

By the summer of 1972, it was clear that 2% real rates were not going to slow the economy or forestall a future inflationary bout. Arthur Burns even noted in his July congressional testimony that “the need for further progress in curbing inflationary pressures remains great…” Nevertheless, Burns failed to act. Similarly, Chairman Powell recognizes that inflation has not been subdued: “More recent data shows solid growth and continued strength in the labor market, but also a lack of further progress so far this year on returning to our 2% inflation goal.” Yet, Powell also appears unwilling to raise rates.

In addition to the headline similarities between 1972 and 2024, there are four important dissimilarities to note:

- A much smaller fraction of the workforce is unionized today, 10% vs. 27% in the early 1970s. As a result, labor is in a weaker negotiating position than it was fifty-two years ago, making a wage-price spiral less likely.

- America’s economy is also more globalized than it was in the early 1970s. Imports have trebled as a percentage of GDP, rising from 4% to 12%. Accordingly, Americans benefit from globalization in a way that we did not historically.

- Today’s high rate of immigration is disinflationary for the service sector in a way that wasn’t true in the early 1970s. Today, 15% of American residents are foreign born, compared to just 4.7% in 1972.

- And, most importantly, we are beneficiaries of a deflationary software revolution.

While the aforementioned factors are all relevant, they are almost all in the process of reversing.

- Biden and Trump are strong supporters of private sector unions. Biden recently joined a UAW picket line, and Trump is courting the Teamsters union for an endorsement. It is also worth noting that in the public sector, federal government workers will receive a 5.2% pay increase in 2024.

- Biden and Trump are for higher tariffs. Biden recently called for the trebling of tariffs on Chinese steel and Aluminum imports. Trump has promised to impose a 60% tariff on all Chinese imports.

- Only Trump would restrict immigration.

- And most importantly, software has become a big enough part of our economy that it is bumping up against real world constraints and becoming inflationary. Last year, we saw generative AI development hampered by a lack of GPU hardware. Looking forward, according to Mark Zuckerberg, future AI expansion will likely be hampered by a lack of available energy. In a recent interview he said:

“You’re gonna run into energy constraints… Getting energy permitted is a very heavily regulated function… There’s no doubt that energy, and if you’re talking about building large new power plants… and then building transmission lines that cross other private or public land, that is just a heavily regulated thing. So you’re talking about many years of lead time… A big [data center] might be around 150 megawatts… No one has built a single gigawatt datacenter yet. I think it will happen; it’s only a matter of time…. To put this in perspective, a gigawatt is around the size of a meaningful nuclear power plant only going towards training a model.”

Markets are concluding that the disinflationary tailwind that characterized the past three decades has passed but have not yet fully grasped the potentially very negative implications of this change. The decline in the stock market from January 1973 to the Fall of 1974 seems unimaginable to today’s investors. In nominal terms, the S&P fell 45%, and in real terms it fell 54%. Even more incomprehensibly to today's investors, this sharp decline was not quickly reversed. The S&P, with dividends reinvested, did not achieve its nominal 1972 peak again until November 1978, at which point it had lost 37% of its purchasing power. In real terms, the stock market did not reach its 1972 peak until October 1982.

As bad as the 1970s were for capital markets, today’s situation could be worse. In 1972, Federal Debt to GDP was 34%. Today that same figure is 122%. With the right policies, America could have ended inflation in the 1970s. We simply lacked the will until Volker took the reins at the Fed. Today, it is not at all clear that, with debt at 120%+ of GDP, a determined Fed could end inflation today the same way that Volker did in the early 1980s. It is an open question as to whether higher rates would make the government’s path more obviously unsustainable and therefore lead to higher, not lower, long-term interest rates. It is also an open question as to whether a recession, which depresses tax receipts, would fix our inflation problem, or call into question the solvency of the Federal government.

In short, this is a perilous moment in America’s financial history, one in which it seems more investors are reawakening to the value of diversification. We are fielding more inbound calls than we’ve seen in a decade – often from investors who have no gold exposure and, in many cases, de minimis commodity exposure. We see great upside in our investments and encourage investors to increase their exposure to resources generally, and gold and silver in particular.

Sincerely,

Equinox Partners Investment Management

[1] Please note that estimated performance has yet to be audited and is subject to revision. Performance figures constitute confidential information and must not be disclosed to third parties. An investor’s performance may differ based on timing of contributions, withdrawals and participation in new issues.

Unless otherwise noted, all company-specific data derived from internal analysis, company presentations, Bloomberg, FactSet or independent sources. Values as of 3.31.24, unless otherwise noted.

This document is not an offer to sell or the solicitation of an offer to buy interests in any product and is being provided for informational purposes only and should not be relied upon as legal, tax or investment advice. An offering of interests will be made only by means of a confidential private offering memorandum and only to qualified investors in jurisdictions where permitted by law.

An investment is speculative and involves a high degree of risk. There is no secondary market for the investor’s interests and none is expected to develop and there may be restrictions on transferring interests. The Investment Advisor has total trading authority. Performance results are net of fees and expenses and reflect the reinvestment of dividends, interest and other earnings.

Prior performance is not necessarily indicative of future results. Any investment in a fund involves the risk of loss. Performance can be volatile and an investor could lose all or a substantial portion of his or her investment.

The information presented herein is current only as of the particular dates specified for such information, and is subject to change in future periods without notice.