Equinox Partners, L.P. - Q4 2013 Letter

Dear Partners and Friends,

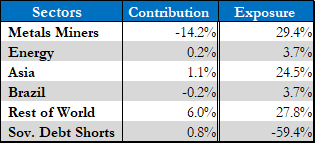

PERFORMANCE & PORTFOLIO

Equinox Partners was down -1.2% in the fourth quarter of 2013 and -7.1% for the full year.[1] To begin 2014, we estimate the fund was down -0.3% in January.

In the first half of 2013, we were sellers of fully-valued operating companies in Southeast Asia and Brazil. Some of this capital was reallocated to other emerging market operating companies, thereby increasing our “rest of world” exposure to 28% as of yearend.[3] We also aggressively bought gold and silver miners and great Indian businesses in moments of panicked selling. We currently own 39 companies, twelve of which were added to the fund in 2013 across multiple geographies and sectors.

While we were surprised by the sharp price declines in both gold and precious metals miners in 2013, we firmly believe that the developed world’s over indebtedness has significant consequences and that monetary manipulation cannot paper over reality indefinitely. This conviction explains our long-standing exposure to gold and silver mining and our willingness to incur the corresponding volatility. Given the 2013 performance of these companies, which overwhelmed the rest of our portfolio, we will devote ourselves to a discussion of this investment in our next letter.

Our non-resource companies, by contrast, performed well last year and grew as expected. Trading at 12x our 2014 estimated earnings and generating both high-teens earnings growth and ROE, we believe these companies remain attractive investments despite their recent good stock performance.

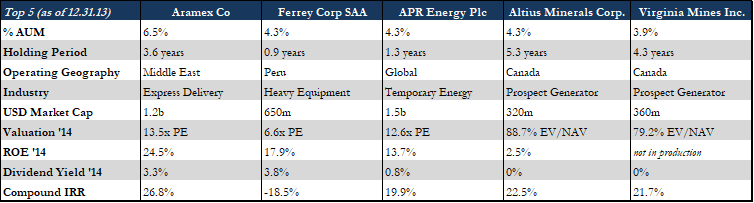

Top Five Holdings

This letter marks the first time we have disclosed our top five positions. Going forward, we will disclose our top five yearend long positions on an annual basis. We began this process in our last letter with a discussion of Aramex, our single largest position. We discuss the other four of our top five in this letter. The valuation table found below serves as a quick summation of all five of these positions.

2013 Yearend Top Five Holdings [4]

Ferrycorp - 4.3% of the fund

Ferreycorp, Caterpillar’s exclusive dealer in Peru since 1942, dominates the Peruvian market for mining and construction equipment and service. The company’s early entry into Peru and its adherence to the Caterpillar business model have allowed it to develop a strong service network. We believe this network represents a sustainable competitive advantage which will allow Ferreycorp to consistently profit from Peru’s high long-term growth potential.

Parts and service availability is critical in the mining and construction industries. Ferreycorp’s customers want their machines constantly available. Maximizing “uptime” is critical to profitability since a single broken part could potentially shutter an entire operation. To this end, Ferreycorp has developed an unparalleled service network in Peru.

Ferrycorp’s competitive advantage is in large part due to its over seventy years of continuous operation in Peru. Its competitors, by comparison, have only been present in the country for a decade or two. Ferreycorp’s service locations and personnel—which dwarf its closest competitor—create a huge advantage for them in the more mountainous parts of the country. Additionally, the company’s strong service network makes customers more likely to buy new equipment from Ferreycorp.

The company’s emphasis on service and parts availability follows Caterpillar’s global strategy. Ferreycorp adheres to Caterpillar’s “Seed, Grow, Harvest” business model: plant seeds by selling new equipment; grow the business by developing strong customer relationships; and harvest the profits by replacing parts and performing repairs. The resulting emphasis on service not only creates customer loyalty but also drives much of the business’ profitability. Parts and service invariably have much higher profitability than a new machine sale. This high-margin service business provides insulation from the cyclicality typically associated with selling capital equipment and helps generate the high-teens returns on capital necessary to fund long-term growth.

Ferreycorp clearly benefits from Caterpillar’s partnership approach to its distributers. Caterpillar recognizes that it benefits from having successful dealers. This dynamic ensures that Ferrycorp can earn high enough returns on capital to further invest in its business and thereby generate more sales for both companies.

Despite the aforementioned advantages, Ferreycorp sells for just 6.6x 2014 estimated earnings.[5] Needless to say, we think the market is significantly undervaluing the company.

apr energy - 4.3 of the fund

Founded by John Campion and Laurence Anderson, APR delivers temporary electrical power via mobile turbines at short notice to anywhere in the world. The company handles everything from transporting the equipment to installing, operating, and maintaining it. Whether it’s an emergency, seasonal, or longer-term electricity need, APR offers an immediate solution for a premium fee, instead of the large capital investment of a power plant. The temporary nature of this business requires developing the scale, the relationships, and the capability needed to maintain high utilization rates. These high barriers to entry, combined with the company’s differentiated equipment offering, have allowed APR to generate a mid-teens return on capital which we hope will rise with increasing capacity utilization.

APR has a solid long-term growth opportunity. The emerging markets, and even some developed ones, face serious shortfalls in their electric-generating power infrastructures for the foreseeable future. These deficits are the result of local governments’ inability to plan for or finance their countries long-term electricity needs. We estimate an electrical power deficit of over 100 gigawatts which should grow at a low-to-mid teens rate.[6] Temporary power fills just a small portion of that overall deficit today.

Even if a competitor was willing to stomach the initial losses and able to overcome the natural barriers to entry, it’s unlikely they will be able to secure the equipment that is best suited for temporary power. APR uses mobile, aero-derivative turbines which are more reliable, fuel efficient, environmentally friendly, and compact than diesel generators or industrial turbines. Only GE and Pratt & Whitney can currently produce this kind of dual-fuel turbine. The latter doesn’t have much capacity dedicated to this business, and APR recently formed an exclusive supply agreement with GE. As a result of that strategic deal, GE now owns roughly 16.5% of APR.[7] The ability of GE to provide not only scarce equipment but also sales leads is a potentially transformational partnership for APR.

While APR is only 10 years old, the company’s CEO, John Campion, has been running temporary power businesses since the early 1990s. He began his career renting diesel generators for various entertainment events. John later headed Alstom Power Rentals which he subsequently purchased in order to form the foundation of what is now APR. John’s industry experience and relationships have allowed the company to obtain supply arrangements with the likes of Pratt & Whitney and GE as well as win large, important mandates. A hard-charging salesman with the technical knowledge of an engineer, John has created an entrepreneurial culture, industry reputation, and customer relationships that competitors have had a difficult time replicating.

APR sells for 12.6x our 2014 estimated earnings. Based on its growth opportunity, industry experience and high return on incremental capital, APR should have the ability to increase its intrinsic value at an attractive rate for a long period of time.

altius minerals - 4.3% of the fund

Altius is a mineral exploration and royalty company. Through the discovery and capitalization of mineral deposits, the company has created a series of royalties that generate free cash flow for Altius’ benefit. The 25% compound annual growth of Altius’ stock since its listing in late 1997 reflects the strength of this business model and the persistent growth of the company’s intrinsic value.[8]

Prospect generation is at the heart of Altius’ model of value creation. Prospect generators focus on early- stage projects—staking claims and doing field work. Prospecting is of course a risky proposition and very few projects ever pan out. These long odds are a perfect match for this high-frequency, low-capital intensive business model. By eschewing the heavy spending needed to test the geological thesis and delineate a deposit, prospect generators are able to both manage the cost of many failures and maintain exposure to successes.

While successful prospect generation requires little financial capital, it requires serious amounts of intellectual capital. Recognizing their competitive advantage, management at Altius has worked hard to develop unparalleled knowledge of their home province of Newfoundland and Labrador. This superior understanding of local geology has allowed Altius to repeatedly stake and acquire the most desirable projects.

In addition to skill in geology, Altius’ founder and CEO, Brian Dalton, has also developed good relationships with strategic investors. Brian’s reputation for honesty and thoroughness has enabled him to bring in outside capital to fund the exploration and development of these projects. For instance, Brian brought together the property, capital, and management necessary to form Alderon Iron Ore Corp. In return for this effort, Altius was able to retain a 25% equity stake in Alderon as well as a royalty on production from the mine.

The capital generated by spin outs such as Alderon has been redeployed into royalties that provide the company with a strong base of cash flow. Notably, Altius recently announced the purchase of a large portfolio of coal and potash royalties in Alberta and Sasketchawan. This royalty portfolio alone will generate close to $30 million in revenues while requiring no ongoing capital investment or administrative cost.[9]

Despite substantial share price appreciation since late December, Altius still trades at a discount to the net asset value of its royalties and equity portfolio. The ability of Altius’ excellent management and the strength of their prospect generation business model should command a substantial premium to this valuation, in our opinion.

virginia mines – 3.9% of the fund

Virginia, a prospect generator in the massive northern region of Quebec known as James Bay, was founded by Andre Gaumond in 1994. Armed with seasoned geologists, a government-led infrastructure build out, and generous provincial tax credits, Andre’s team set out to map and explore northern Quebec for profit. Their dedication and savvy produced a 17.7% annualized return over the past 18 years.[10] Today, Virginia owns a highly-valuable royalty on Goldcorp’s Éléonore mine and a large portfolio of attractive exploration assets.

Virginia’s success stems from management’s perfection of a cost-effective approach to exploring their large land package in Northern Quebec. Andre developed relationships with the geology departments at local universities—pulling in their best students to assist the company’s summer programs—and in doing so, transformed the seasonal nature of field work into an advantage. During the winter, when field work is more expensive or even impossible, a smaller, permanent team painstakingly analyzes the data that is collected and tests drill targets. Over the past two decades, this seasonal, low-cost approach has produced the only accurate database of the geology in James Bay.

In late 2004, the company’s disciplined approach resulted in a major discovery of high-grade gold on Virginia’s Éléonore property. To optimize the value of this success, Andre initiated an auction process that resulted in the sale of the asset to Goldcorp and the retention of a royalty for Virginia. Given the size of the Éléonore asset and the dependability of Goldcorp as the operator, this royalty is widely recognized to be the best gold royalty not owned by a multi-billion dollar company.

The value of this economically robust royalty has been reflected in Virginia’s stock performance during the recent bear market in mining stocks. Last year, while the GDXJ junior gold mining index was down 61% and the gold price was down 28%, Virginia actually appreciated 6% in USD.[11] Importantly, Virginia’s Éléonore royalty not only provides downside protection but it also offers exposure to future exploration success.

Andre incorporated an escalator into the Éléonore royalty by scaling the percentage owed to Virginia from 2.2% to 3.5% of revenues as cumulative production rises.[12] Having recently visited Éléonore, we believe that Goldcorp is building infrastructure for a mine that will ultimately extract significantly more than the 7.7 million ounces of current resources from this deposit.[13]

Beyond Éléonore, Virginia holds a vast portfolio of early-stage prospects. The company is actively working twelve projects in James Bay, with total exploration expenditures in 2013 of $15 million largely funded by its partners. The most notable of these projects is the Coulon deposit, a high-grade poly-metallic system. While this deposit will need to grow to support economic development, we are confident Virginia will manage the risk and rewards of further exploration appropriately.

At $1250 gold, we estimate the value of the Éléonore royalty plus the company’s cash on the balance sheet are worth more than the current share price of Virginia. A higher gold price, the long-term growth of Éléonore, or other discoveries on the company’s massive land package provide substantial upside. Given its size and quality, we suspect that the Éléonore royalty would even command a substantial premium in the current depressed environment. Should such a transaction materialize, we are confident that Andre will handle the sale of the Éléonore royalty with the same aplomb that he showed in the initial sale to Goldcorp. Meanwhile, we happily retain our exposure to this exceptional management team as they manage the monetization of Éléonore and third-party spending on their properties.

Sincerely,

Andrew Ewert

Sean Fieler

Daniel Gittes

William W. Strong

END NOTES

[1] Returns stated for Equinox Partners, L.P. Returns will differ for Equinox Fund International, Ltd.

[2] Sector and country returns are presented herein on a gross basis and use relevant period P&L and average capital in determining contribution. Cash and equivalents are excluded. P&L from equity shorts held during early 2013 are included in Rest of World and Asia sectors.

[3] “Rest of World” operating companies trade in the US, Saudi Arabia, UAE, UK, Peru, and Georgia.

[4] Compound IRR is calculated from position’s inception and accounts for incremental buys/sells. Information from Equinox Partners proprietary analyst models are subjective in nature and based on many assumptions. Although believed to be reliable, models have not been independently verified and accuracy or completeness cannot be guaranteed. ROE of Aramex and APR adjusted for goodwill. ROE of Altius only includes producing assets. Net Asset Value (NAV) is the present value of future discounted cash flows. Altius and Virginia use NAV valuation because we believe current earnings do not reflect the full value of these companies. NAV calculations involve assumptions about interest rates, discount rates, commodity prices, production levels and tax rates, among others, any of which may be incorrect.

[5] Valuations derived from internal models.

[6] Sources: Projected deficit for 2015 per Oxford Economics; Platt’s; Strategic Analysis. Growth figures per Aggreko 2013 Strategy Presentation.

[7] Source: Company filing TR-1 per Bloomberg dated 1/30/14.

[8] Stock appreciation per Bloomberg.

[9] Source: Internal proprietary model.

[10] Internal performance calculation assumes all proceeds from the sale of Virginia Gold were reinvested into Virginia Mines.

[11] Stock performance per Bloomberg.

[12] Rate of increase presumes gold price exceeds $500/ounce.

[13] Source: Goldcorp 2012 Revenue and Resource statement.