Equinox Partners, L.P. - Q3 2003 Letter

Dear Partners and Friends,

Investing in an American-Centric Era

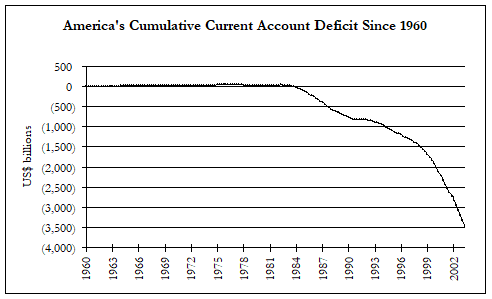

Most Americans are either unaware of, or worse, aware but unconcerned by, the current torrential inflow of foreign capital into US Dollar denominated assets, a flow essential to maintaining America’s privileged role in the global economy. US capital markets, likewise, have remained blithely optimistic despite their dependency on foreign capital, a dependency which places America’s economic well-being in a precarious position. We doubt conventional investors really appreciate what would happen to their “investments” if America’s current account was to actually return to balance.

It is our contention that even the relatively sophisticated American investor has become excessively provincial in his thinking, believing that if he is not investing overseas he is not taking currency or political risk. It is understandable that after an extended period of US Dollar hegemony few in our country even ask the question, “Are US Dollar denominated assets risky, and if so, what are the alternatives?” Perhaps, this pair of key financial questions is not being given enough attention simply because many find the resulting conclusions quite discomforting. Namely that overseas investing, even emerging market investing, is not as risky as one might think, while keeping one’s investments in US Dollar denominated securities is not as safe as it appears.

Americans undoubtedly recognize the risk posed to others who keep the entirety of their capital invested domestically. Think Thailand in 1997, Russia 1998, Brazil 1999, etc. One consequence of these crises is that the continual analysis of political and economic risk has become a way of life for wealthy Thais, Russians and Brazilians. But few Americans, or domestic investors in the developed world for that matter, regularly engage in this same sort of analysis as they simply do not believe themselves to be subject to the same macroeconomic forces that regularly buffet the developing world. Accordingly, when the next major macroeconomic crisis does strike a developed economy, the knock-on effects promise to be massive, as such an event will force wealthy individuals across the developed world to wrestle with these difficult issues.

Within the developed world, America’s position is particularly fraught with risk. Ever since the dollar established itself as the world’s unquestioned reserve currency, the conventional American investor has become basically incapable of even weighing the Dollar’s strengths and weaknesses. At the present moment, when the data are supporting substantial de-dollarization, even the best informed can’t bring themselves to take meaningful action. Few Americans can get their heads around the idea that the US Dollar may be a risky place to be.

From our stock specific long positions in excellent undervalued foreign businesses, precious metals companies and energy producers, to our short positions in overvalued US tech and financial stocks, Equinox is well positioned in the event that someday global capital markets make a more judicious appraisal of the US Dollar’s strengths and weaknesses.

Asia’s Consumer Boom Favors Equinox’s Asian Stocks

Asians are “embarking on a consumption and lifestyle boom that strongly echoes the American Baby Boomer era. Only bigger.” (Gary Coull of CLSA)

“’These days who wants to save?’ asks the young bank clerk hurrying between jewelry shops during her lunch break at MBK shopping mall in Bangkok… After decades of stashing away their savings, Asia’s rapidly growing middle classes are turning into voracious consumers.”[1] This new consuming class is driving “a revolution in Asia that is likely to transform global spending patterns.”[2] As owners of established consumer brands and dominant consumer franchises, Equinox is positioned to benefit from the burgeoning of an Asian consumer class.

Asians’ disposable income levels are low but rising quickly--thereby providing them the incremental buying power to rapidly increase their consumption of non-essential goods. Furthermore, Asian households’ balance sheets are in especially good shape. After generations of very high rates of savings, a mere decline in those rates to more normal levels will foster a substantial incremental increase in consumption. Asia’s demographics also support growing consumption. Their youthful population, accelerating household formation, and declining household size call to mind America’s demographic situation thirty years ago. Finally, younger Asian’s relatively liberal attitudes about consumption and credit contrast sharply with their parents’ parsimony.

Economic progress driven by the consumption aspirations of younger Asians, opposed to Asia’s export driven growth of the second half of the twentieth century, will help to reduce the region’s dependence on world economic conditions. This change in Asia’s appetite for consumption could form the basis for a significant alteration of global capital flows. If the large-scale movement of savings from the thrifty East to spendthrift America turns out to be unsustainable, there are profound implications for world capital markets. At the very least, such a change would sever Asian stock markets’ correlation with Wall Street. It might also result in a meaningful long-term upward revaluation of the Asian securities in which Equinox is invested.

[1] Financial Times October 2003

[2] Financial Times October 2003

Equinox’s Global Investment Perspective

The process of overseas investing has, over time, affected the way we at Equinox view the worldwide investment landscape. We have become global investors, as opposed to simply owners of foreign stocks. As our long term partners know, over the years, our knowledge and understanding of foreign markets has generated a sequence of superior investments. Among our insights: the clearly superior prospective returns to investors in Canadian energy companies over those of their southern neighbors, a nuanced appreciation of the important changes in select Korean corporate managements as a consequence of the Asia Crisis, and, most recently, the extraordinary shorting opportunity presented by Japan’s massively overvalued bond market. This last decision to short Japanese government bonds, instead of reestablishing shorts on grossly overvalued US technology shares as many other contarian funds did earlier this year, appears to have been a particularly profitable one.

Our decision years ago to eschew a strategy of tightly managing volatility was, and remains, controversial. We have used the freedom that comes from this decision to focus our resources on company specific research, and we have in turn used our understanding of these specific companies to exploit the unwinding of persistent global economic imbalances. From our perch as international value investors, we identified several huge valuation anomalies evident in world equity markets that provided a once in a lifetime opportunity to generate extraordinary absolute returns. Despite the excellent results that this strategy has generated for our partners in recent years, the opportunity to further profit from the unwinding of these imbalances still has a long way to go.

Sincerely,

Sean Fieler

William W. Strong