Equinox Partners, L.P. - Q2 2016 Letter

The dollar and equinox

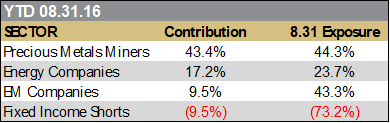

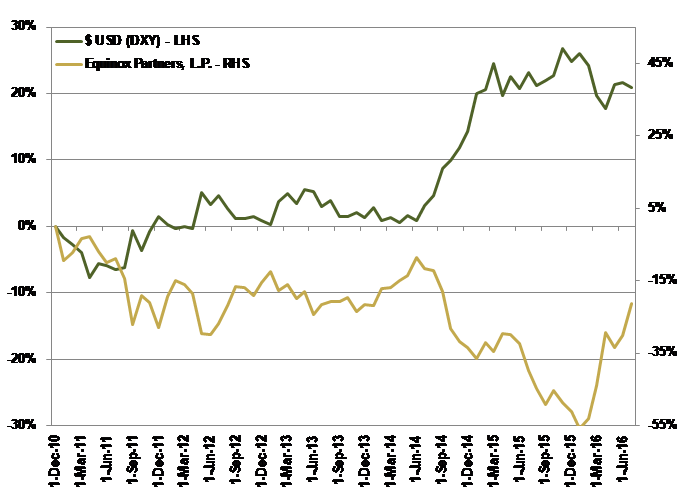

As the adjacent, near-mirror image makes clear, Equinox and the U.S. dollar index (DXY) have been inversely correlated for years. Since January 2011, the monthly correlation is -0.58 (r). But, the graph also shows that the impact of this correlation has been changing. Specifically, the recent sideways drift of the U.S. dollar index bears little resemblance to our fund’s 2015 decline or 2016 appreciation. Rather, these last two years are reminiscent of the pre-2011 period during which investment fundamentals overwhelmed other factors. In the letter that follows, we will detail the nature of our fund’s relationship with the U.S. dollar index, and explain why the U.S. dollar’s value against other developed world currencies is not a reliable guide to our fund’s performance over time

A review of recent instances in which the U.S. dollar index declined or appreciated by 5% or more provides a useful starting point for our analysis. Short-term declines in the U.S. dollar index of 5% or more during 2013, 2015, and 2016 translated into positive performance for our fund of 9.6%, 9.6%, and 31.5% respectively. Conversely, the sharp 25.8% rally in the U.S. dollar index from June 2014 to March 2015 corresponded to a 28.0% decline in our fund.[2] Moreover, we have every reason to believe that precipitous, short-term moves in the U.S. dollar index will continue to have an inverse short-term effect on our fund.

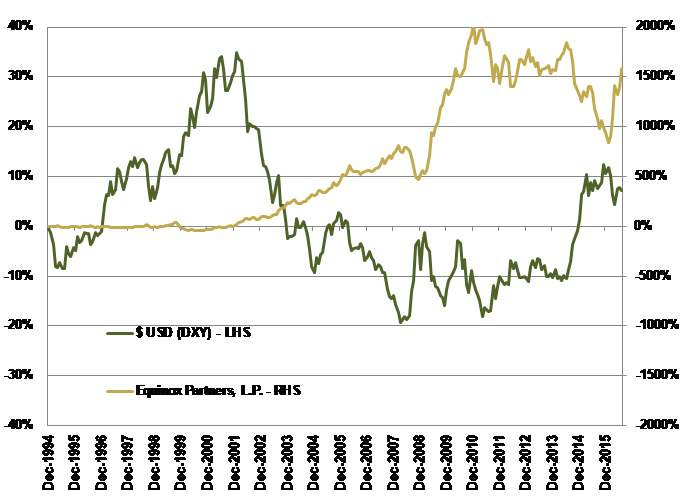

This short-term inverse correlation does not, however, provide a reliable indication of our fund’s performance over time. There are two principle reasons for this divergence. First, sharp, short-term moves in the U.S. dollar index tend to cancel each other out over time. Second, and more importantly, the intrinsic value of our companies has compounded over time, while the dollar’s value against other developed world currencies has remained range bound.

Our fund’s muted long-term relationship with the U.S. dollar index becomes obvious when the relationship is graphed over the twenty-two years since our fund’s inception (below). Over this period of time, both our fund and the U.S. dollar index are up. Specifically, over the past twenty-two years, the U.S. dollar index is up +12%, while Equinox is up 15 times. This result strongly suggests that the movement of the U.S. dollar index tells us little about the cumulative performance of our fund in the long term. Rather, over time, the underlying fundamentals of our investments remain the best proxy for performance.

Of course, to the extent that oil, gas, gold, and silver prices are largely driven by moves in the U.S. dollar index, our focus on fundamentals might appear circular. In this regard, it is worth noting that the aforementioned all fell as the U.S. dollar index declined during 2015, while their results were mixed during the 2013 decline in the U.S. dollar index. Against this backdrop of muddled data, the argument that gold, silver, gas, and oil are all up this year principally because the U.S. dollar index is down, strikes us as a weak argument.

Quite clearly, in the case of oil and gas, supply-demand dynamics have been the principle driver for their positive year-to-date performance. And, the logic of the supply-demand balance has next to nothing to do with the U.S. dollar index. These two commodities, which had been in structural oversupply, are now in closer balance as reflected in the appreciation of their prices and the related E&P equities that we own. This closer balance between supply-demand, not the fall in the U.S. dollar index, best explains the increase in oil and gas prices for the year to date.

The inverse correlation of the U.S. dollar index with gold and silver is of course more closely related to the fundamentals of these monetary metals. Gold and silver are, after all, U.S. dollar alternatives. But, gold and silver are also monetary alternatives to the euro, yen, and the other developed world currencies that comprise the peer set against which the U.S. dollar is measured in its index. Moreover, since the turn of the twenty-first century, gold and silver have performed well not only against the dollar, but also against all developed world currencies. Accordingly, the dollar’s relative weakness against the euro, yen, British pound, Swiss franc, and Swedish krona, as captured in the U.S. dollar index, is not an explanation of the longer-term appreciation of gold and silver. Rather, the relative appreciation of these monetary metals against developed world currencies is the result of developed world central banks’ collective policy of currency devaluation. So long as the developed world’s central banks are committed to easy money, gold and silver are likely to continue remonetizing.

The correlation between the U.S. dollar index and our fixed income shorts in Japan, Europe, and the U.S. is equally complex. There is, of course, a strong-U.S. dollar index-higher-rate scenario which would be good for our bond shorts, i.e. the U.S. economy improves and the Federal Reserve normalizes rates. But, there is also a weak-U.S. dollar index-weak-bond scenario in which the Fed fails to raise rates sufficiently as inflation picks up. In either of these scenarios, bond fundamentals would deteriorate and we would profit. The more problematic scenario, from our perspective, involves less-pronounced fundamentals providing an unremarkable backdrop against which increased levels of central bank manipulation could drive bond prices higher.

Finally, with respect to the superior emerging markets businesses we own, a weak U.S. dollar index is generally better, but only within limits. With few exceptions, our overseas companies principally conduct business in local currencies. So, a weaker dollar makes their business more valuable in dollar terms while also making emerging market economies less susceptible to capital flight. Should, however, a weak U.S. dollar index reflect a recession in the U.S., it would be a short-term negative for our emerging markets investments regardless of the extent to which our specific companies are fundamentally insulated from the U.S. economy.

It is worth reiterating that we have no strong opinions as to how the U.S. dollar will fair against other developed world currencies. The U.S. dollar/euro and U.S. dollar/yen cross rates, which together account for over 70% of the U.S. dollar index, have become highly politicized, and therefore highly unpredictable. Consequently, we feel no need to take a position or even have an opinion on the dollar/yen or the dollar/euro rate. Instead of taking a position on the relative merits of various developed world currencies, we’ve positioned our fund so as to both avoid and capitalize on the unsustainable cycle of debt and aggressive monetary policy that continues to characterize the entirety of the developed world.

Having positioned ourselves on the right side of financial history, we spend the vast majority of our analytical resources identifying and analyzing specific businesses. We are company-specific value investors operating in extraordinary times. While it is important to avoid a conventional portfolio construction in times like these, it is equally important that we never lose focus on the merits of the specific companies we own. For, only by owning superior, undervalued companies and aligning ourselves with exceptional managements, will we generate superior returns while minimizing permanent losses over the long term. To emphasize the company-specific nature of our work, we conclude with a description of Crew Energy, a top-five position that captures the type of company-specific opportunities that are also aligned with today’s macroeconomic and geopolitical fundamentals.

Crew Energy

Crew Energy, a Calgary-based E&P company exposed to oil and gas pricing in roughly equal proportions, is far superior to a direct investment in oil and gas in our opinion. We believe that at strip pricing (prices which by definition will generate no return for an investor in oil and gas futures) Crew will rapidly grow both its production and cash flow.

At strip prices, we expect Crew to grow production from 22,000 boepd (barrel of oil equivalent per day) to 60,000 bpd in 2019. In addition to this production growth, we expect Crew to take its operating cost per barrel down from $6 today, to less than $4 over the same time period. As a result, Crew’s cash flow should grow faster than its production. We estimate that Crew will generate around $80m CAD of cash flow this year and more than $325m in 2019.

With a market cap of $900m CAD and an enterprise value of $1.2b CAD, Crew is trading at 7.5x next year’s cash flow—a discount to the average North American E&P company. Needless to say, this discount reflects skepticism about Crew’s ability to achieve its three-year growth and cash flow targets. This skepticism strikes us as misplaced given that Crew has both the land and, with the benefit of asset sales, sufficient internally-generated cash flow to achieve this growth without raising equity.

This remarkable disconnect between Crew’s value and valuation, can in part be explained by the company’s size and location. But, more generally, the investment opportunity in Crew exists because markets are not efficient. Capturing such compelling company-specific opportunities has been and will remain central to our success.

Sincerely,

Sean Fieler Daniel Gittes

END NOTES

[1] Performance contribution derived in US dollars, gross of fees and fund expenses. Interest rate swaps notional value and P&L included in Fixed Income. P&L on cash excluded from the table as are market value exposures for derivatives. All company-specific data derived from internal analysis, company presentations, or Bloomberg.

[2] Analysis details daily peak-to-trough gain/loss for the DXY index versus Equinox Partners performance, as calculated over the same periods using gross IRR derived from fund P&L and average, period capital. Graph shows month-end data for both the DXY index and Equinox Partners net returns; axes adjusted to visualize correlations.