Equinox Partners, L.P. - Q1 2019 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

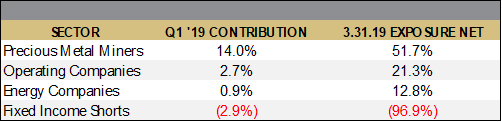

Equinox Partners, L.P. was up +14.4% in the first quarter of 2019 and is up +8.4% for the year through May 8.

the federal RESERVE'S FUTURE

For a decade, our portfolio and quarterly letters have reflected our conviction that the Fed would not be able normalize interest rates. The Fed’s pivot since December is clear evidence that we remain correct about this critical point. Meaningfully positive real rates of interest are incompatible with our deeply indebted economy.

We have also long believed that once it became clear the Fed could not normalize interest rates that the Fed would begin to lose credibility. This has not happened, at least not yet. In fact, despite their recent flip-flop on rates, the Fed now appears to be more powerful than ever. At the moment, the Fed seemingly has the power to manage not just the bond market, but the stock market and the economy as well. Incredibly, these powers appear impervious to President Trump’s open advocacy for lower rates and the mainstreaming of Modern Monetary Theory (MMT).

A variety of forces have underpinned the Fed’s remarkable resilience. First and most importantly, other developed world central banks continue to pursue radical monetary policies, making the Fed appear normal on a relative basis. Second, the U.S. dollar has proven indifferent to political criticism of Fed policy and growing U.S. fiscal deficits. Third, inflationary expectations remain firmly anchored. And, fourth, investors remain confident that the Fed will keep both long and short-term interest rates low. As a result of these factors, the Fed finds itself with at least the appearance of an increased, rather than diminished, ability to influence the price of financial assets and manage the economy.

The mainstreaming of MMT at a moment when the Fed enjoys the perception of heightened powers is no coincidence. The Fed’s appearance of being able to do so much naturally leads to demands to do even more. No future U.S president is going to sit idly by as the Fed tightens monetary policy to manage the bond market while the alternative, bond buying, remains potentially costless. Instead, future presidents will demand a Fed that finances more growth if they are Republicans, or funds more government solutions if they are Democrats. These escalating political demands will eventually push the Fed to its breaking point, unless the market does so first.

As such, the critical question for investors is what is the likely outcome for financial assets when the Fed’s powers of manipulation eventually fail? Historically, an overextended Fed would have spooked the bond market. But, with quantitative easing now just another tool in their toolkit, this is not our base case. Moreover, with other central banks in the same boat as the Fed, it is not clear to us that the dollar will weaken relative to the euro, yen & pound. What is clear to us is that the gold price will strengthen as the Fed demonstrates its limitations.

The real puzzle for gold investors is why gold prices are not already significantly higher given the Fed’s actions in recent years. Having mulled this question over since gold’s 2011 peak, we believe that gold has undergone its own form of “quantitative easing.” While the supply of physical gold has increased by less than 2% a year, the supply of gold futures and derivatives has expanded much more rapidly. The effect of this supply of paper gold has been particularly noteworthy this year. Just in the past month, there have been two instances of over $1b of notional gold sold into the futures market in the space of minutes. While the unexpectedly abundant supply of gold futures for sale has nothing to do with the physical supply of gold, it has had a clear effect on the gold price in the short term.

Happily, growing central bank gold demand will not be satisfied by the seemingly limitless supply of gold futures and other derivatives. Central banks don’t want paper gold, and they are increasingly insisting on physical delivery of the gold they own. The same is true of Asian gold demand. Over time, growing central bank and Asian investor demand for physical gold will make the abundant supply of gold futures and derivatives less relevant to the price of gold. Needless to say, the result should be a much higher gold price. And, with central banks accumulating gold at the fastest pace in 50 years, we believe the peak of paper-gold’s influence should soon be behind us.

Since 2011 weak gold prices have coincided with even weaker shares of gold mining companies. The compounding of these bear markets makes it possible for us to own excellent companies with great management at low valuations at a time when the underlying commodity that they produce is itself undervalued. We currently own gold mining companies at fractions of their NAV and at low multiples to cash flow. Given the attractive risk/reward of these investments and the path the Fed is on, we’ve allowed our weighting in gold mining companies to touch 60% for the first time.

We also remain short low-yielding sovereign and corporate debt. We continue to own deeply out-of-favor E&P and emerging market companies that are not part of the financial asset price bubble. And, we’ve begun to add to our equity shorts that are part of the bubble. The ten-year bull market in U.S. equities has given rise to a crop of businesses that are overvalued, capital intensive, and vulnerable to competition. Tesla clearly fits this bill. We’ve also recently shorted shares of Alarm.com and Netflix, to name two new positions. Our short equity exposure is presently -7.4%. While we are mindful that today’s frothy investment environment could become crazier still, the time is ripe for adding equity short positions.

Responsible Investing is hard work

We continue to right-size our business to correspond with the ~$500m of assets we have under management. In January, we replaced our trader, Gerald Kane, with Nicholas Engel, an existing analyst and experienced trader. The change was made possible by the implementation of a new order management system that greatly reduces the time required to execute and settle trades. Nick is able to better integrate our research and trading activities, which is an obvious advantage. At the end of April, we parted ways with Dan Gittes, a partner of 15 years who joined us straight out of Williams College in 2004. During his time here, Dan accumulated broad experience in emerging markets. We wish both Dan and Gerry well in their next endeavors. Our team of 11 people now consists of six investment professionals and five in operations.

Sincerely,

Sean Fieler

[1] Sector exposures shown as a percentage of 3.31.19 pre-redemption AUM. Performance contribution is derived in U.S. dollars, gross of fees and fund expenses. Interest rate swaps notional value and P&L are included in Fixed Income. P&L on cash is excluded from the table as are market value exposures for derivatives. Unless otherwise noted, all company data is derived from internal analysis, company presentations, or Bloomberg. All values are as of 3.31.19 unless otherwise noted.

[2] Source: As observed by our trader on Bloomberg. See also: ZeroHedge and usagold.com