Kuroto Fund, L.P. - Q4 2020 Letter

Dear Partners and Friends,

PERFORMANCE & PORTFOLIO

Kuroto Fund gained +14.0% in the fourth quarter of 2020 and was up +4.1% for the full year. By way of comparison, the EM index was up +19.6% in the fourth quarter and +18.4% for the year. [1]

The principle cause of our underperformance in 2020 was the fund’s zero weighting in China, South Korea, and Taiwan. The MSCI emerging markets index is 67% weighted to these three countries, which were up 27%, 38%, and 30% respectively in 2020.

On a fundamental basis, we believe our portfolio is superior to the MSCI emerging markets index in terms of value, yield, and profitability. Our portfolio is trading at 6.3x our estimate of earnings in 2021 while the index is trading at 16x consensus ’21 estimates. Our estimated dividend yield is 5.5% for 2021, the index’s dividend yield is 2%. Finally, our estimated ROE is 18%, while the index’s ROE is 10%. While none of these metrics perfectly captures our portfolio, taken together we think they give a sense of the attractiveness of what we own.

yearend Top-five holdings

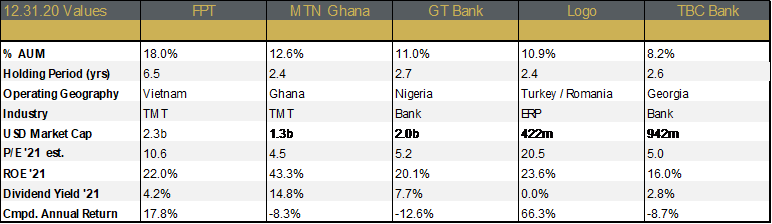

Our five largest investments going into 2021 are FPT, MTN Ghana, Logo Yazilim, Guaranty Trust Bank, and TBC Bank. TBC Bank is new to our list and Georgia Capital dropped down at year-end. This change is due to TBC Bank’s superior relative stock performance to Georgia Capital this year. Georgia Capital remains our sixth largest position.

FPT Group: 18.0% of 12.31.20 Partners’ Capital

FPT Group is a Vietnamese technology company with a thirty-year track record of enviable growth and returns. Founded in 1990 by Dr. Truong Gai Binh, FPT has grown to be Vietnam’s leading technology group. FPT owns Vietnam’s largest software outsourcing business, largest private IT university, largest streaming service, a leading cloud business, and one of the country’s three broadband networks. The common thread in all of these businesses is FPT’s meritocratic culture which has allowed the group to attract the country’s top tech talent.

During the downturn of early 2020, FPT’s businesses proved remarkably resilient. After the pandemic hit Vietnam, we thought FPT’s businesses would decline by double digits. That didn’t happen. Through the first eleven months of 2020, FPT grew revenue 7.6% and earnings by 11.7%. FPT’s growth should accelerate in 2021. In August, the company’s newly signed contracts were more than double those signed last year. Companies are more dependent on technology providers than ever before, providing a strong tailwind for all of FPT’s businesses.

FPT currently trades at just over 10x our 2021 earnings estimate. This valuation reflects a severe under-appreciation of its business. Similar businesses trade at more than double the valuation of FPT. We think that the undervaluation is a product of two factors: Vietnam’s status as a frontier rather than emerging market, and the premium to the local price required for foreigners to acquire the shares. We are happy to continue owning a business growing earnings at a mid-to-high-teens rate and paying a 3.5% dividend while we wait for its eventual upward reevaluation.

MTN Ghana: 12.6% of 12.31.20 Partners’ Capital

In 2020, MTN Ghana’s telecom and mobile-money businesses grew unabated through the local lockdowns. Through nine months, the company grew revenue 19% and earnings 53%. Data and payments/money transfers both grew over 20% and voice revenue grew over 10%. The company managed to take out 400 basis points in expenses through various efficiency initiatives, which caused such rapid earnings growth for the year. In 2021, we expect the business to continue growing revenues and profits at a high-teens rate, to continue earning 40%+ returns on equity, and to pay us a mid-teens dividend yield.

MTN’s strong performance is a direct result of the company’s market dominance. MTN manages 56% of Ghana’s voice calls, 67% of data, and over 90% of the country’s mobile-money transactions while generating operating margins of 39% and an ROE of 42%. MTN’s unique competitive positon and economic characteristics are very similar to those of Safaricom in Kenya, but the valuation of the two companies is very different. While Safaricom trades at 18x estimated earnings with a 4.5% dividend yield, MTN is trading at 4x our estimate of 2021 earnings with a mid-teens dividend yield.

This difference in valuation is attributable to several factors, the most obvious is the illiquidity of MTN Ghana’s shares. Only 15% of the shares float and fewer than 5% of the shares turnover on an annual basis. That said, MTN is just as dominant as Safaricom from a competitive standpoint and MTN’s market is actually less penetrated than Kenya. Therefore, MTN should be able to grow at a faster rate than Safaricom. The macroeconomic fundamentals of Ghana are not drastically different from those of Kenya; Ghana is actually growing in real terms at a faster rate than Kenya. Moreover, Ghana, just made it through a successful election, in which Akufo-Addo was reelected to a second term.

Guaranty Trust Bank: 11.0% of 12.31.20 Partners’ Capital

For thirty years, GT bank has honed its ability to operate in one of the world’s most difficult jurisdictions, Nigeria. While other Nigerian banks have engaged in politically motivated loans, GT bank has preserved its reputation as the safest Nigerian banks that lends to only the best Nigerian credits. As a result of this prudence, depositors are willing to accept very low yields. This, in turn, allows GT bank to generate 20%+ ROEs while taking very little credit risk. So, even in a year like 2020, in which the oil price declined substantially, Nigeria is struggling, and system-wide non-performing assets are rising, GT bank is still generating healthly profits.

GT bank’s conservativism has not only allowed the business to weather Nigeria’s economic and political ups and downs, but has also allowed management to plan strategically for the future of finance in Nigeria. As a result, at a moment in time when many of its peers are figuring out how to dig out of their troubled balance sheets, GT bank is about to spinoff a digital finance business that management has been incubating for several years.

In early 2021, GT Bank will convert into GT Holdco. This transaction will separate GT Bank from its digital payments business as well as several other digital and non-bank businesses, including insurance, wealth management, and a popular entertainment app. This decision will give the non-bank businesses more of a focus and an opportunity to raise capital separately if warranted. Given that these types of businesses trade on a revenue multiple rather than an earnings’ multiple, the spinoff could unlock significant value for shareholders. GT bank currently trades at just 1.1x book value and 5.5x our estimate of earnings in 2021.

The reason for such low multiples on such a high quality bank is that Nigeria’s macroeconomic policies remain a mess. The country’s parallel exchange rate and associated capital controls are a deterrent for most foreign investors. Add to this macroeconomic dysfunction the serious security problems in both the North and South of the country, and it’s easy to see why the company trades at such low valuations.

While Nigeria’s flaws are obvious, its virtues are less well understood. Having long been Africa’s most populous country as well as the continent’s largest oil producer, Nigeria is finally going to produce refined products that are consumed domestically. Aliko Dangote’s single-train oil refinery complex, built at an estimated cost of $15 billion USD, will begin operations this year. For years, this project has been a huge drag on the country’s current account. When up and running, this complex will process 650k barrels per day of oil and drastically improve Nigeria’s balance of payments. The government also struck a deal with Siemens to help fix its intermittent supply of local electricity, and it has made steps towards deregulating the price of electricity and gasoline. While Nigeria will remain a difficult place to do business, it offers an exceptional long-term opportunity for companies like Guaranty Trust that have a proven ability to operate there.

Logo Yazilim: 10.9% of 12.31.20 Partners’ Capital

Logo is Turkey’s largest software company. Founded by Tugrul Tekbulut in 1984, Logo provides enterprise resource planning (ERP) software to Turkey’s small and medium sized businesses (SME). With a market share that is more than double the size of the next largest competitor, Logo has achieved an extremely defensible positon in the Turkish market. Logo’s dominance amongst Turkish SMEs is a result of its localized, flexible, and affordable service offering.

Given Logo’s scale and advantage in R&D and service, the inherent stickiness of the ERP business, and the complexity of the local requirements for SMEs in Turkey, we think that Logo will continue to dominate its market in Turkey for the foreseeable future. Moreover, Logo’s market is expected to continue to experience double-digit secular growth due to low penetration relative to comparable markets. This secular tailwind is being helped by the government’s aggressive push to digitalize the Turkish economy. These factors should continue to drive Logo’s rapid top-line growth going forward.

Logo currently trades at 20x our 2021 earnings estimate. While this is a higher multiple than we typically pay for businesses, it is more than merited by Logo’s high rate of secular growth. The impact of the global pandemic was barely noticeable in Logo’s financial statements. Logo grew revenue 27% in the first 9 months of the year, and grew operating earnings by 29%.

TBC Bank: 8.2% of 12.31.20 Partners’ Capital

TBC Bank and the Bank of Georgia account for more than 70% of the banking sector’s assets and liabilities in the nation of Georgia. The power of this duopoly is such that the vast majority of Georgians have an account at one of these two banks, and many have accounts at both. In fact, combined, the banks have just under 5 million customers, while Georgia has a population of only 3.7 million adults. TBC and the Bank of Georgia use their privileged position in the Georgian economy to generate 20% ROEs while taking very little credit risk. With so many accounts in such a small country, TBC Bank and the Bank of Georgia have a near complete picture of Georgians’ financial situation and lend accordingly.

This knowledge was put to the test in 2020. Tourism accounts for 40% of the goods and services of the country and for a low-teens percentage of TBC and Bank of Georgia’s loan books. In April, the worst month of the pandemic from an economic standpoint, Georgian GDP was down by 16%. The banks in conjunction with their regulator decided to tackle the crisis head on and recognize all estimated pandemic-related losses upfront. This is the opposite of the approach taken in the rest of Europe. The Georgian banks were able to do this because they entered the crisis on a strong financial footing. Even after taking pandemic related losses into account, we believe that both banks will earn a high single-digit ROE in 2020.

That both banks continue to trade below book value despite their resilience is a result of two factors. First, Georgia is a small country in a difficult neighborhood that does not attract the interest of most investors. Second, both TBC and the Bank of Georgia are prohibited from buying back stock or paying dividends as part of the pandemic related measures implemented by the local regulator.

TBC is only leveraged 7.5 times on an asset to equity basis, and using IFRS methodology it posted a 15% capital adequacy ratio at the end of Q3. As of Q3, NPLs to gross loans were 3.5% and NPL coverage was 105%, or 216% including collateral. At some point in 2021, we think it is likely that the central bank will lift the capital return provisions and the bank will be free to pay a divided or buy back stock. Either option will be great for a bank trading at just 5x earnings.

Sincerely,

Sean Fieler Brad Virbitsky

END NOTES

[1] Performance stated for Kuroto Fund, L.P. Class A on a net basis. An investor’s performance may differ based on timing of contributions, withdrawals, share class, and participation in new issues. Unless otherwise noted, all company-specific data is derived from internal analysis, company presentations, or Bloomberg. Company valuations and exposures are as of 12.31.20.